Life Insurance Rates by Age Chart

Get a free life insurance quote

- Choose the right insurance

- Business Insurance

- Business Owner’s Policy

- Commercial Auto

- Commercial Property

- General Liability

- Life Insurance

- MIA Dental Insurance

- MIA Vision Insurance

- Professional Liability

- Surety Bonds

- Workers Compensation

- Select state

Protecting your family is of utmost importance, and life insurance provides you the peace of mind they will be taken care of no matter what happens.

However, it can be daunting if you don’t know much about life insurance, especially when it comes to life insurance rates.

Let’s learn about how life insurance rates are calculated in general and provide a quick guide about how life insurance rates can differ by age.

How are Life Insurance Rates Calculated?

Life insurers use a combination of factors when calculating the premiums they will charge their policyholders.

Here are the most common ones:

- Age. Younger individuals are generally considered to be less risky to insure than older individuals.

- Health. Individuals who are in good health will typically pay less for life insurance than those who have pre-existing medical conditions or those who engage in risky behaviors such as smoking.

- Lifestyle. Individuals who engage in high-risk activities, such as skydiving or rock climbing, may be charged higher premiums.

- Coverage amount and term. The higher the coverage amount and longer the policy term, the more expensive life insurance will be.

- Occupation. Certain occupations are classified as higher risk and will put the insured at a greater chance of premature death than the average individual, resulting in higher premiums.

Although it may seem quite complicated, the concept behind it is rather easy to understand: life insurers want to assess the risk of insuring you. The higher the risk, the higher the premiums.

How Does Age Affect Premium Rates?

Age is a key factor that insurers consider when calculating life insurance premiums. In fact, life insurance rates can differ significantly by age, as it’s one of the most important indicators of life expectancy.

Generally speaking, people get closer to death as they get older. For this reason, older individuals typically have to pay higher premiums for life insurance than younger individuals.

For example, a 20-year-old who buys a 20-year term life insurance policy will have a lower premium than a 40-year-old who buys the same policy. This is because the 20-year-old is less likely to die during the 20-year term of the policy compared to the 40-year-old.

Additionally, age also affects other factors like medical conditions. As you age, the chances of developing health conditions increase, which in turn also impacts the life insurance rates.

For this reason, it’s often recommended that people purchase life insurance while they’re still young and in good health, as this can help to lock in a lower premium rate. Not to mention, some policies are no longer available once you reach a certain age.

To help you better understand the difference in life insurance rates by age, we’ve put together the chart below.

Life Insurance Rates by Age Chart

As mentioned above, age is an important factor that insurers consider when calculating life insurance premiums. This means looking at the average life insurance rates depending on each age group can be a great way to get an idea of what your possible premiums could be.

Baby Life Insurance

Baby life insurance might make little sense at first, but there are some good reasons to purchase life insurance for your children.

The most common reason is to ensure they will have coverage that they can take advantage of later in life. Additionally, if a child has a pre-existing medical condition, purchasing life insurance now may help them to get coverage at a more reasonable rate later in life.

There are also term life insurance policies that you can convert to permanent life insurance once your child grows up and becomes independent. Locking it in early lets them enjoy the benefits of a lower rate for life.

Lastly, by getting them a life insurance policy that comes with a cash value, they can use it as a savings vehicle for future financial goals like college tuition or a first home.

Life Insurance For Children

Children are typically unable to take out their own life insurance policies, so family life insurance is a popular option for providing coverage.

Family life insurance provides coverage for the entire family and is typically cheaper than purchasing separate policies for each member. It may also provide additional benefits such as coverage for childcare costs and accidental death.

That said, there are some whole life insurance policies that allow the policyholder to add their family, like minor children, as riders. This usually requires additional premium payments, but it can be a great way to get your children the coverage they need.

Here are the average life insurance rates for babies and children aged 1-15 years old.

Life Insurance For Young Adults to Adults

Young adults and adults are typically able to purchase their own life insurance policies, so they don’t need to be added as riders on a family life insurance policy.

Here are sample calculations for a 10-year term life insurance for individuals aged 20 to 50 years old with average health.

Life Insurance For Seniors Over 60

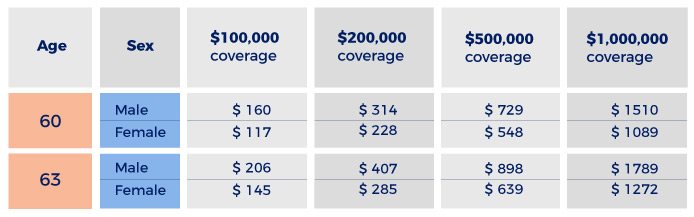

Senior citizens over the age of 60 usually face much higher life insurance rates. This is especially true for those who are in poor health, have existing medical conditions, or have a history of hospitalizations or surgery.

To give you an idea, here are sample insurance premiums for a healthy, non-smoking senior buying term life insurance for a duration of 10 years, divided by sex.

Life Insurance For Seniors Over 70

Life insurance premiums for seniors over the age of 70 are certain to go up significantly, as this is when many people start to experience health issues and become more prone to medical problems.

The following chart shows sample insurance premiums for a healthy, non-smoking senior over 70 buying term life insurance for a duration of 10 years, divided by sex.

Life Insurance For Seniors Over 80

It’s not easy to find life insurance for those over 80, particularly term life insurance, but there are some options available.

Additionally, whether or not an 80-year-old should get insurance in the first place is very subjective. Some factors to consider include the senior’s overall health, the size of their estate, and any outstanding debts or financial obligations that may need to be covered after their death.

It’s always best to speak with a financial advisor before making a decision about purchasing life insurance at any age, but more so when you’re a senior over 80. If you’re uncertain, reach out to us here at Magnum Insurance, and we’ll help you get the best life insurance policy for your needs.

Getting the Best Life Insurance Rates With Magnum Insurance

At Magnum Insurance, we understand that life insurance can be confusing. But no matter how old you are and where you are in life, it pays to understand how life insurance works and how to get the best rates.

Luckily, Magnum Insurance offers personalized life insurance plans tailored to your needs and budget. Regardless of your age, health status, or budget, our team of experts can help you find the best life insurance policy for your individual situation.

And when you’re ready, you can get an instant life insurance quote from Magnum Insurance. Reach out today to get the protection you need for you and your family!

Related Links

Magnum Insurance makes Life Insurance easy

Get a free Life Insurance quote today

- Choose the right insurance

- Business Insurance

- Business Owner’s Policy

- Commercial Auto

- Commercial Property

- General Liability

- Life Insurance

- MIA Dental Insurance

- MIA Vision Insurance

- Professional Liability

- Surety Bonds

- Workers Compensation

- Select state

Is there a local Life Insurance agent near me?

Try our Location Finder to find the nearest agent near you.