Whole Life Insurance

Get a free life insurance quote

- Whole Life Insurance

- Term Life Insurance

- Permanent Life Insurance

- How Does Life Insurance Work

- No-Medical-Exam Life Insurance

- Family Life Insurance

- Life Insurance Rates by Age Chart

- Understanding the Benefits of Life Insurance

- Variable Life Insurance

- Life Insurance as an Investment: Pros and Cons

- Term vs. Whole Life Insurance

The world seems to be becoming more dangerous, and we just can’t leave the financial security of loved ones up to fate. That’s why getting life insurance is critical for your financial life.

While nobody likes to consider the possibility of their own death, life insurance is an essential financial safety net for your family’s future. It offers invaluable protection in case something unexpected happens, ensuring that those you love will be cared for if the worst occurs.

Let’s delve into this policy that provides the peace of mind of knowing that those closest to you are taken care of – even when you’re gone.

What is a Whole Life Insurance Policy?

Whole life insurance is a type of permanent life insurance that provides coverage for the policyholder’s entire lifetime as long as premiums are paid on time.

It also typically includes other features, such as an investment component and a cash value.

Whole Life Insurance vs. Other Types of Permanent Life Insurance

If you’re familiar with permanent life insurance, you’ll know that there are many types, each with its own particular set of features. Whole life insurance is one type, and it differs from other permanent policies in a few distinct ways.

- Premiums. Whole life insurance typically has fixed premiums that remain level throughout the policy’s lifetime. Other types of permanent life insurance, such as universal life or variable universal life, may offer more flexibility in premium payments.

- Cash value. Whole life insurance policies build cash value over time, which grows at a guaranteed rate set by the insurer. This cash value can be used to pay premiums, take out loans, or even be surrendered for its full cash value.

- Death benefit. The death benefit for whole life insurance policies is generally fixed and guaranteed, meaning it will not change over time as long as premiums are paid on time.

- Investment risk. Insurers bear the risk associated with building cash value within the policy. In other types of permanent life insurance, such as variable universal life, the policyholder typically takes on some or all of the investment risk by choosing how to invest their cash value.

Overall, whole life insurance is often considered a simpler and more conservative option compared to other types of permanent life insurance due to its fixed premiums, guaranteed death benefit, and cash value growth.

Whole Life Insurance Cost

The price of your whole life insurance premiums will vary depending on several key factors. If you want to know how much your whole life insurance will cost, you need to think about the following factors:

- Age. Insurance premiums are generally higher when you get older because the likelihood of experiencing health issues or passing away increases as you age.

- Health. Individuals in better health will typically be able to get whole life insurance at a lower cost.

- Gender. Men have a shorter life expectancy than women, so their whole life insurance premiums are typically higher.

- Occupation. People who work jobs deeply associated with higher risks, such as police officers or firefighters, may pay more for whole life insurance.

- Lifestyle. Your lifestyle habits like drinking, smoking, and other risky behaviors could increase the cost of whole life insurance. Risky hobbies like skydiving or mountaineering can also lead to higher premiums.

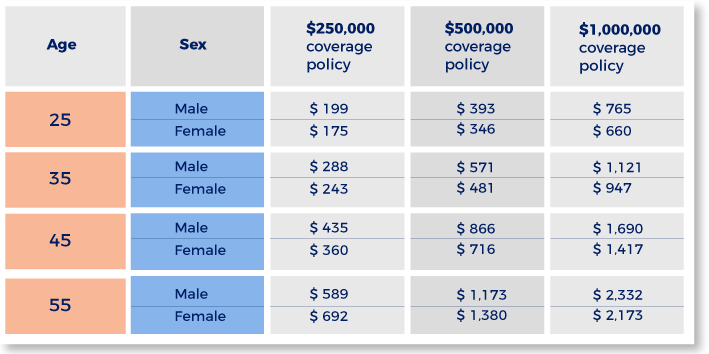

Whole Life Insurance Rates by Age Chart

Whole life insurance rates can vary greatly depending on the policyholder’s situation.

Here are the average premiums in the United States for whole life insurance by age and gender.

Getting Whole Life Insurance With Magnum Insurance

Whole life insurance is a powerful and reliable way to provide financial security for your family in the event of your death.

With Magnum Insurance, you can get whole life insurance that is tailored to meet your specific needs and budget.

Don’t wait any longer to get the life insurance coverage you need. Call Magnum Insurance now and get a free quote!

Magnum Insurance makes Life Insurance easy

Get a free Life Insurance quote today

Is there a local Life Insurance agent near me?

Try our Location Finder to find the nearest agent near you.