A Simple Guide to Your Term Life Insurance Cost

Are you thinking about how to protect your loved ones if something were to happen to you? That’s what term life insurance is all about. It provides a financial safety net for your family, making sure they’re taken care of if something happens to you.

Whenever the topic comes up, the first question on most people’s minds is – How much is life insurance?

That’s a great question, and the answer really is simple. Think of term life as the most easy-to-understand type of life insurance. You choose a coverage amount and a set amount of time – say, 20 years. For those 20 years, you make a steady payment. If you pass away during that time, your family receives the full coverage amount. The price you pay is based on the basics, like your age and health, but a few other things can play a part, too.

But you don’t have to figure this out alone. At Magnum, our job is to make it all clear and simple. We want you to understand the real benefits of life insurance, so we’ll walk you through how the costs are determined, step by step, so you can feel confident and in control.

Table of Contents

- TL;DR

- The Building Blocks of Your Life Insurance Cost

- It’s More Than Just Health: Your Lifestyle Matters

- A Savvy Way to Save: “Laddering” Your Policies

- A Quick Look at the Extra Fees

- Flexibility for the Future: The Conversion Option

- How Magnum Makes It All Simple

- Final Thoughts

TL;DR

- Your age and gender are the two big starting points that influence your term life insurance premium

- Insurers look at the big picture of your lifestyle, including your hobbies and job, to understand your overall risk

- Your job’s stress level can be a factor, as it can be linked to long-term health

- Believe it or not, your zip code can have a small effect on what you pay for life insurance

- Being honest about your health is key, and showing how you manage a condition is always a good idea

- “Laddering” multiple smaller policies instead of one large one can be a smart way to save money as your coverage needs change over time

- Besides the premium, there can be other small charges, like a fee for paying your bill in monthly installments

- A “conversion option” is a helpful feature that lets you switch your term policy to a permanent one later on if your needs change

The Building Blocks of Your Life Insurance Cost

The price you pay for life insurance – your “premium” – is tailored just for you. It’s not a one-size-fits-all number. Understanding the basic building blocks can help you find the best value and know what to expect.

Timing Can Slash Your Life Insurance Costs

It’s no secret that life insurance is more affordable when you’re younger. A term life insurance rates by age chart shows that prices don’t just inch up – they can take big jumps as you get older. The simple reason is that as we age, our health risks naturally increase. It’s a bit like buying a plane ticket – the earlier you book, the better the price you can lock in. That’s why getting a policy when you’re young is such a smart move. It can save you a ton of money down the road.

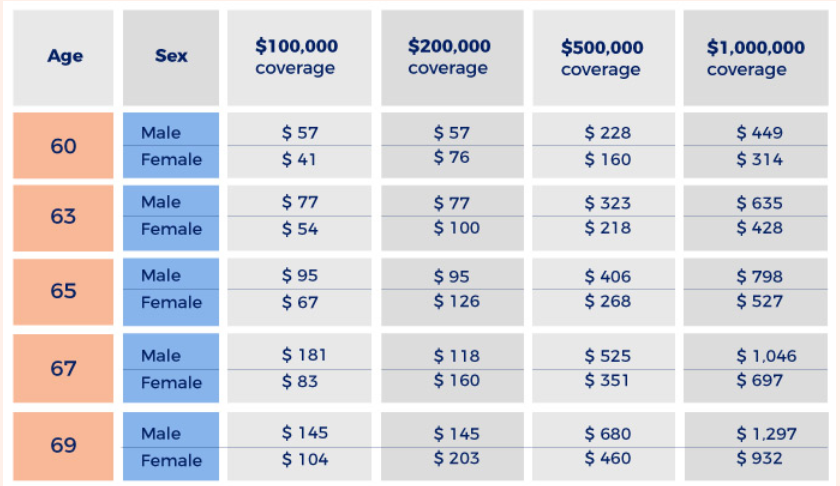

Let’s look at a term life insurance rate chart by age, from 60-69, to see what I mean –

Source: Magnum Insurance

A Helpful Tip: The 5-Year Age Band

Understanding life insurance rates by age helps you make a smart decision. Here’s a little tip that can be helpful. Most insurance companies group their prices in 5-year bands. For example, you’ll often pay the same price whether you’re 35 or 39. But the day you turn 40, you move into a new, more expensive bracket.

Sometimes, people put off buying a policy for just a year or two while they finish a degree or save for a down payment. But waiting just a few months can sometimes mean missing out on that lower age band, leading to a higher life insurance premium for the entire 10, 20, or 30-year term. It’s just something to keep in mind as you plan.

Men and Women Often Pay Different Rates

Did you know that men and women often pay different premiums? Even fraternal twins with the same job and health might get different quotes. So, how much does term life insurance cost for each?

Generally, men tend to pay more for coverage, especially in their 40s and beyond. This is because, statistically, women have a longer life expectancy. It’s one of the many factors that go into creating a personalized quote. It’s details like these that help explain why life insurance rates can be so different from person to person.

We believe being on your side is the only way to do business. That means our team is here to answer your questions honestly, and we’ll always be clear about what a policy costs and what it does for you. We’re not here to just sell you a product. If we think a different plan makes more sense for your family, we’ll be the first to say so. Your best interest is our only interest.

Another Big Factor: Tobacco Use

Beyond age and gender, one of the single biggest factors in your life insurance rate is whether or not you use tobacco. Because of the clear health risks, a smoker will almost always pay a much higher premium than a non-smoker of the same age and health profile. If you’ve recently quit, that’s great! Most companies want to see that you’ve been tobacco-free for at least a year or two before they’ll offer you non-smoker rates, so it’s a great incentive to stick with it.

It’s More Than Just Health: Your Lifestyle Matters

When you apply for insurance, companies try to get a complete picture of your life to understand your overall risk. This goes beyond your basic health checkup and includes your hobbies, your job, and even where you live. It’s all about making sure the price is fair, because everyone’s story is a little different.

Your Hobbies and Habits Tell a Story

Insurance companies want to know if you have a particularly risky lifestyle. It’s just a practical part of figuring out your overall risk. For example, if you’re into hobbies like skydiving, scuba diving, or rock climbing, it might affect your premium because those activities carry a higher chance of accidents.

The same goes for your daily habits. If you have a history of buying tobacco products, insurers will see that as a health risk. On the other hand, things like having a gym membership, running 5Ks, or buying fitness equipment can sometimes work in your favor, as they point to a healthier, lower-risk lifestyle.

How Your Job Can Affect Your Rate

It makes sense that a physically risky job – like being a logger or a pilot – can affect your life insurance rate. But what many people don’t realize is that even some office jobs can play a part. Insurers sometimes look at very high-stress careers, like finance or law, as a small risk factor because of the health problems that can come from long-term stress.

On the other hand, jobs that are often less stressful, like teaching, might be seen as a positive. It’s not about judging what you do for a living. It’s just about getting a clear picture of your day-to-day life.

Your Location Can Be a Factor, Too

Believe it or not, your address can also play a small role. Insurance companies use broad statistics for different regions. Factors like local crime rates, environmental quality, and even general access to healthcare facilities in your area can slightly influence your premium. It can feel a bit unfair, as these are things that are mostly out of your control. That’s why it’s just one small part of a much bigger picture.

Source: Magnum Insurance

A Savvy Way to Save: “Laddering” Your Policies

Want to save money on the cost of life insurance? Many people buy one large policy and keep it for decades, but that can mean you’re paying for more coverage than you need in the later years. A practical approach called “policy laddering” can help you get the right amount of coverage for each stage of your life, often while saving you money.

Instead of one giant policy, you buy a few smaller policies with different term lengths (e.g., 10, 20, and 30 years). This way, as your financial needs decrease over time, you can let the shorter-term policies expire, lowering your total premium.

Laddering Example

Let’s look at an example. Meet Maria, a 35-year-old from Illinois. She and her spouse just bought a new home with a 30-year mortgage. They have two young children, ages 3 and 5, and they want to make sure there’s enough money for college down the road.

Her biggest needs are –

- The Mortgage: A 30-year, $300,000 mortgage

- College for the Kids: They’ll be in college roughly 15-20 years from now

- Income Replacement: To support her spouse until retirement

Instead of buying one huge 30-year policy for, say, $1 million, Maria could “ladder” her coverage like this –

- Policy 1 (10 Years): A smaller $150,000 policy. This adds extra protection during the most expensive, youngest years of her children’s lives. It expires after 10 years, lowering her bill

- Policy 2 (20 Years): A $350,000 policy. This covers the kids through their college years and the majority of the mortgage. It expires after 20 years, lowering her bill again

- Policy 3 (30 Years): A $500,000 policy. This is the foundation, providing income replacement and covering the mortgage until it’s paid off

By laddering, Maria only pays for the high level of coverage she needs right now. As her needs shrink, her coverage and her total premium shrink, too. It’s a smart way to make sure your coverage matches your life, so you’re not paying high life insurance rates for protection you no longer need.

Source: Magnum Insurance

A Quick Look at the Extra Fees

Your premium is the main cost of your policy, but there are often small administrative fees to be aware of. These aren’t hidden secrets, but standard charges that are good to know about before you sign up. For example, many companies add a small processing fee if you choose to pay your premium monthly instead of annually. It’s usually more affordable to pay once a year if you can.

These small fees are also something to keep in mind when you’re looking at term vs. whole life insurance options. They often have different kinds of administrative fees, so comparing them helps you see the true long-term cost of each.

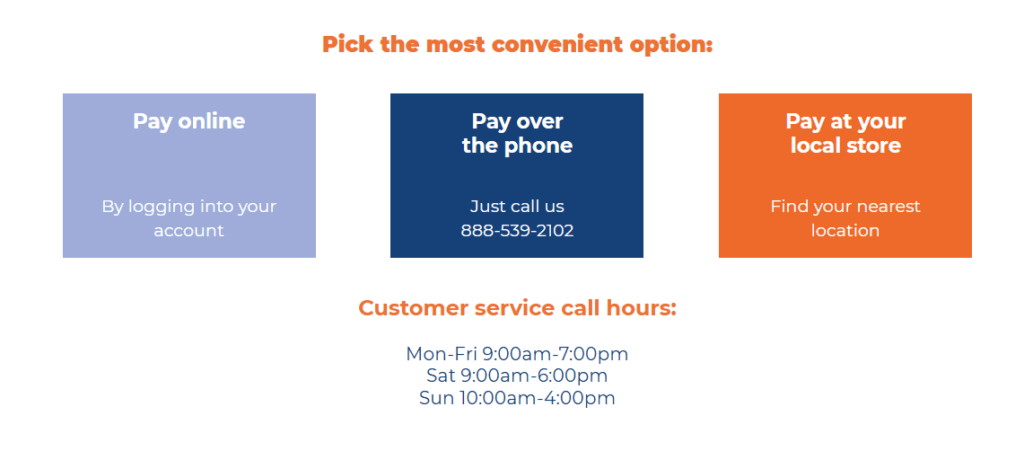

We know it can all sound a bit confusing. That’s why we’re always happy to break it down for you. When you work with Magnum, we make sure to point out any and all fees so you understand the true cost of your life insurance. You can give us a call or stop by one of our locations, and we’ll walk you through everything, line by line, with no surprises.

Source: Magnum Insurance

Flexibility for the Future: The Conversion Option

Think of a conversion option like “locking in” your good health. It’s a feature in many term life policies that can be a huge help down the road.

It gives you the right to switch your term policy to a permanent one later on, no new health questions asked. This is a huge deal. If you develop a health condition years from now, a new policy could be very expensive. But this feature lets you get a new plan based on the health you had when you first signed up.

It might add a little to the initial term life insurance cost, but knowing you have that option down the road can be a huge relief. It’s a great safety net that keeps you in the driver’s seat as your life changes.

How do you know if the conversion option is worth it? It helps to think about permanent coverage a little differently. While term life is all about protection, some people view permanent life insurance as an investment in their family’s long-term financial future because it builds cash value over time.

How Magnum Makes It All Simple

We know all these details can feel like a lot to keep track of. You’re busy with work and family, and you don’t have time to become an insurance expert. That’s where we come in.

We’re on Your Side, Not on a Sales Quota

At Magnum Insurance, our main job is to clearly explain how life insurance works. That’s the advantage of working with our independent insurance agents. As a broker, we’re not tied to one single company. This means our only goal is to shop around for you, comparing options from many different carriers to find the right coverage at the right price. We do the heavy lifting so you don’t have to. It’s all about our promise – Better Price, Better Service.

We Know Your Neighborhood

We’re proud to be part of the neighborhood. For over 40 years, we’ve been helping families in communities all across Illinois, Indiana, Texas, Arizona, New Mexico, and Nevada.

Being a good neighbor is important to us. We live here, too, so we get what life is like for working families in our communities. That’s why we take the time to find the right coverage for our neighbors. We’re not a big, faceless corporation – we’re a local business, proud to be part of your community.

We Make It Easy

Your life doesn’t stop at 5 p.m., and neither should access to your policy. Our online tools and mobile app let you manage your policy, get proof of insurance, or make a payment on your schedule, whether it’s at noon or midnight. We know that cash flow can be a real concern for families, so we work hard to find carriers that offer flexible payment options to fit your budget.

Final Thoughts

So, what should term life insurance cost? The honest answer is that it’s different for everyone. It depends on your age, your health, your lifestyle, and your needs.

The most important thing is that the process should feel simple and clear. You shouldn’t have to worry about secrets or confusing rules. We’ve seen good people pay more than they need to, simply because no one took the time to explain things. We think that’s just not right. That’s where we come in.

We know that term life insurance isn’t a one-size-fits-all product. That’s why our job is to share helpful insurance insights and give you the confidence to make the right choice for your family. It all starts with a simple conversation where we listen to what you need. Then, we do the shopping for you to find the best policy for your situation.Our goal at Magnum isn’t just to sell you a policy. It’s to give you the right amount of coverage at the best possible price and find a plan that changes right along with you. Give us a call today, or visit our website, where our friendly team is available, and we’ll be happy to answer all your questions.

Quote online or give us a call

- Choose the right insurance

- Business Insurance

- Business Owner’s Policy

- Commercial Auto

- Commercial Property

- General Liability

- Life Insurance

- MIA Dental Insurance

- MIA Vision Insurance

- Professional Liability

- Surety Bonds

- Workers Compensation

- Select state

- Arizona

- Illinois

- Indiana

- Nevada

- New Mexico

- Texas