Non Owner SR22 Insurance Cost: A Simple Guide to Saving Money

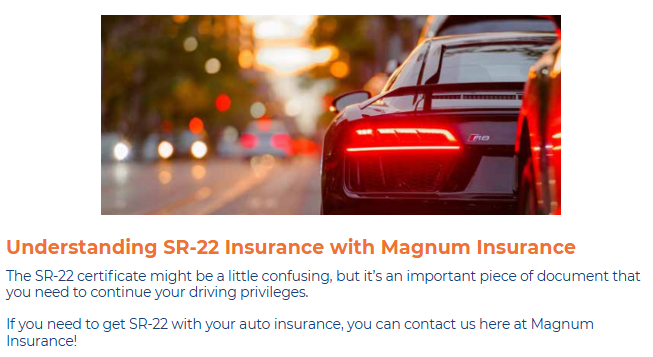

Let’s be honest – dealing with insurance can feel overwhelming, especially when it comes to SR-22. If you’ve been told you need an SR-22 but don’t own a car, you’re not alone in feeling confused. Most people find it strange to pay for “invisible” insurance on a car that isn’t in their driveway.

This hesitation is normal, but delaying can lead to bigger problems like fines or a longer requirement period. It’s helpful to remember that this insurance isn’t about protecting a car – it’s about protecting you and your driving privileges. Honestly, the unexpected can happen at any moment, and it’s simply proof to the state that you’re covered.

Understanding this helps when you look at the non owner SR22 insurance cost. Many people get sticker shock because they compare it to a regular auto insurance policy, but it’s like comparing apples to oranges. A non owner SR22 policy is a specific tool designed only to cover your liability when you borrow a vehicle. Looking at it this way helps you see that it’s not an unnecessary burden, but a practical solution for your unique situation.

Table of Contents

- TL;DR

- What Really Goes Into Your SR-22 Cost? Let’s Break It Down

- Moving? How a New State Can Affect Your SR-22

- Getting Through Your SR-22 Period Smoothly

- How Modern Life Affects Your SR-22 Needs

- Smart Ways to Handle Your SR-22 Payments and Plan

- How Magnum Insurance Makes It All Easier

- Final Thoughts

TL;DR

We know life is busy. If you don’t have time for the full article, here are the most important takeaways:

- Feeling confused about SR-22 insurance is normal, but letting that confusion cause delays can cost you more in the long run

- Small, one-time state filing fees can be part of the total cost. It’s good to know about them upfront so there are no surprises

- If you drive for work, like for a delivery app, you’ll likely need extra coverage. A basic non owner SR22 policy usually doesn’t cover business driving

- Staying organized and keeping good records is your best tool for a smooth journey through your requirement period

- Thinking about your SR-22 as a financial plan, not just a bill, can help you find ways to save money and stay on track

- For most people, a traditional policy is the simplest and most affordable way to get back on the road

What Really Goes Into Your SR-22 Cost? Let’s Break It Down

So, you’ve wrapped your head around why you need non owner SR22 insurance, but now comes the next big question: what’s it actually going to cost? It’s okay to wonder just how SR-22 insurance works when it comes to pricing. When you think about the non owner SR22 insurance cost, it’s easy to focus on the monthly payment, but there are a few other pieces to the puzzle that make up the total price. Think of it like buying a concert ticket. There’s the price of the ticket itself, but then there might be a small service fee or a facility charge. SR22 insurance is a bit like that.

The Small Fees – State Filings and Admin Costs

One of the first things you’ll encounter is a state filing fee. This is a small, one-time fee that the insurance company pays to the DMV to file your SR-22 form. The filing fee for the SR-22 is typically around $25, but it can vary based on your state and insurance provider. It’s a standard part of the process, whether you need a Texas SR22, or are filing in Illinois, and Arizona. While it might seem small, it’s one of those little costs that are good to know about from the start. Some companies may also have small administrative charges for the paperwork involved in processing and managing the filing.

To make it even clearer, here’s a simple breakdown of the kinds of fees you might see –

| Hidden SR22 Cost Components | Typical Range | How Often it Occurs |

| Initial Filing Fee | $15-$50 | One-time |

| Administrative Processing | $10-$25 | Per Incident |

| Reprocessing for Lapses | $25-$75 | Per Lapse |

| Multi-state Coordination | $20-$40 | Per Additional State |

| Document Preparation | $5-$15 | Per Filing |

Seeing it laid out like this helps remove any surprises. Our goal is to make sure you understand every part of the process, so you can budget accordingly and feel confident in your plan.

The Biggest Risk – Why a Policy Lapse Can Cost You Big

The most important thing to avoid is a lapse in your coverage. Missing even one payment can cause a real headache. If your policy is canceled, your insurance company is required by law to tell the state immediately. This is called a Form SR-26, and it can trigger an immediate suspension of your driver’s license. This means you might have to pay fines, reinstatement fees to the DMV, and start your SR-22 period all over from the beginning. That’s a financial and logistical setback that is completely avoidable.

Your Simple Checklist for Staying on Track

This is why we always tell our friends and clients to set up automatic payments. It’s the easiest way to make sure you never miss a due date. Think of it as putting your peace of mind on autopilot. Here’s a simple checklist to help you stay on track –

✅ Set up automatic payments

✅ Keep your coverage active with at least the minimum liability your state requires

✅ Update your info if you move or change your phone number

✅ Know your end date

✅ Document everything

This is where having the right people in your corner can make all the difference.

Having an independent insurance agent really has its advantages, especially when you aim to find the best non-owner SR22 insurance cost. As an independent broker, Magnum works for you, not for a single insurance company. Our job is to shop around and compare different SR22 insurance quote options to find the one that gives you the best value.

Moving? How a New State Can Affect Your SR-22

Life happens. People move for new jobs, for family, or just for a change of scenery. But if you have an SR-22 requirement, you might be wondering, “What happens if I move to another state?” It’s a great question, and the answer can have a real impact on your situation. While you must file your SR-22 in the state that requires it, the rules and costs can be different from one place to another.

The Interstate Filing Process

Let’s say you live in Indiana and have an SR-22 requirement, but you land a fantastic new job in Las Vegas, Nevada. You can’t just cancel your Indiana policy and get a new one in Nevada. Your requirement is tied to Indiana. However, you’ll need to prove to both states that you are maintaining continuous coverage. This involves getting a new policy in Nevada that meets their liability requirements and having your agent perform an “interstate filing” to notify Indiana that you’re still compliant.

How a Partner Can Help with an Interstate Move

Understanding how your new home state handles SR-22 can help you plan ahead. Some states have shorter requirement periods for certain violations, while others might have lower overall insurance costs. This is not about trying to “game the system,” but about being smart and informed.

This is another area where having a knowledgeable partner on your side is so important. Trying to figure out the rules for two different states can be complicated. But at Magnum, we’re licensed in states like Illinois, Indiana, Texas, Arizona, New Mexico, and Nevada.

Since we know the local rules, we can help take the worry out of moving. We’ll be right there with you to get your SR-22 car insurance squared away, making sure it’s done right for your new home state.

Getting Through Your SR-22 Period Smoothly

So, your SR-22 is filed. Now what? The goal is simple: get to the finish line without any bumps in the road. The state sets the time you need it for, but staying organized can make the whole process feel smoother. It also helps you get the SR-22 taken off your record without any extra hold-ups when your time is finally up.

Source: Ai-generated

Can You Finish Your SR-22 Requirement Early?

Everyone asks this question – “Can I finish my SR-22 requirement early?” While the timeline is usually set in stone by the state, you can control how smoothly it goes. The best way to avoid adding extra time is to prevent any mistakes. Forgetting a payment, for example, can cause a lapse in coverage. That could reset the clock, forcing you to start all over again. Nobody wants that.

This is where good record-keeping becomes your best friend. It helps you keep track of everything and be ready the second your requirement is over.

Early SR22 Termination Documentation Template:

Here’s a simple checklist to help you keep all your important papers in one spot. Think of it as your personal success kit. When that finish line arrives, you’ll have everything you need, ready to go –

- Compliance start date: ___________

- Required end date: ___________

- Records of Monthly Payments: ___________

- Copies of All DMV correspondence: ___________

- Log of Calls with Your Insurance Company: ___________

- Any Relevant Court Documents: ___________

- Proof of a Clean Driving Record: ___________

How Modern Life Affects Your SR-22 Needs

From new technology to the rise of the gig economy, it’s important to know how these changes connect with your SR-22 requirement.

How Technology is Changing Insurance Pricing

It feels like technology is changing everything these days, and insurance is no exception. Not long ago, the cost of SR-22 insurance was based on just a few basic things, like your age and driving record. But now, insurance companies have access to more information and are using technology to create much more personalized pricing. This can be a good thing, because it means your premium can be based more on your individual circumstances.

The good news is that this technology also helps us serve you better. With tools like our mobile app, you can manage your policy right from your phone. You can make a payment during your lunch break, check your policy details, or pull up your information if you need it. It’s all about making the process more convenient for you.

The Rideshare Gap – Is Your SR-22 Enough?

More and more people are picking up side hustles, driving for rideshare companies like Uber and Lyft, or delivering food for services like DoorDash. It’s a great way to earn extra money on your own schedule. But if you have a non owner SR22 requirement, it adds a new layer to consider. No matter what, the unfortunate truth is that there are accidents and deaths on our roads. That’s why having the right coverage is so important.

Here’s something many people don’t realize though – a standard non owner SR22 policy is designed for personal use. That means it covers you when you borrow a friend’s car to run errands. However, it usually doesn’t cover you when you’re using that car for business, and that includes driving for a rideshare or delivery app. This is what’s known as a “coverage gap,” and it can be a big financial risk.

The Right Protection for Your Side Hustle

Let’s imagine you’re driving for a delivery service and get into an accident. For instance, what does car insurance cover in an accident?

Well, if you only have a personal non owner SR22 policy, the answer might be “not much.” Your insurance company could deny the claim because you were using the car for commercial purposes, leaving you responsible for the damages.

So, what’s the solution? You’ll likely need to add what’s called rideshare or commercial auto coverage to your insurance plan. This is a special kind of protection designed for when you’re using a vehicle for work. It closes that dangerous gap and makes sure you’re properly protected. Yes, this will add to your non owner SR22 insurance cost, but the cost of not having it is so much higher.

Smart Ways to Handle Your SR-22 Payments and Plan

When you’re facing an SR-22 requirement, it’s easy to think of it as just another bill you have to pay. But what if you thought about it differently? What if you treated it like a financial goal, with a clear beginning and end? By approaching your SR-22 with a smart financial mindset, you can find ways to manage the cost effectively and maybe even turn it into a positive.

Turning Your SR-22 into a Financial Win

First, let’s talk about the total cost. It’s more than just the monthly payment. It’s the sum of all your payments over the entire time you need the SR-22, plus any fees. Knowing this total number helps you see the big picture. SR-22 insurance cost varies, even for those who don’t own the vehicle. However, by planning ahead, you can manage it well. Non-owner SR-22 insurance typically costs less than standard SR-22 policies since it doesn’t include comprehensive or collision coverage. This is already a financial advantage.

Did You Know? On-Time Payments Can Help Your Credit

One clever strategy is to think about what else you could be doing with that money. If your monthly premium is $75 a month. Over three years, that’s $2,700. Every late fee you avoid is money that stays in your pocket. Did you know that handling your SR22 payments responsibly can even help your credit? Magnum works with all credit histories, and when you make consistent, on-time payments, some insurance companies may report your positive history to credit bureaus. This can gradually help build your credit score over time, which is a fantastic long-term benefit.

A Good Time to Review All Your Insurance Needs

This period is also a great time to look at your whole financial picture. Are there other areas where you could save? Sometimes, when we’re forced to focus on one financial thing, it helps us get organized everywhere else. This might be the perfect moment to review all your insurance policies. You might have motorcycle insurance or boat insurance that could be bundled for a discount. At Magnum, we can help you with all of it, from SR-22 and auto insurance to home insurance, and even life insurance or health insurance. Our goal is to be your one-stop shop for protecting everything that matters to you.

Are There Alternatives to SR-22 Insurance?

While a traditional SR22 insurance policy is the most common path forward, we want you to know all the options that are out there. In certain states, like Texas and Arizona, there are other ways to meet the state’s financial responsibility requirement. These aren’t for everyone, but it’s good to know they exist.

Here’s a quick look at the different methods –

| Alternative Compliance Method | Upfront Cost | Ongoing Cost | Who It’s For |

| Traditional SR22 Insurance | $0-$100 | $50-$150/month | Most drivers needing to meet state requirements |

| Cash Deposit or Bond | $10,000-$75,000 | $0 | Individuals with significant liquid assets |

| Surety Bond | $100-$500 | $0 | Those who can get credit approval from a bond company |

| Self-Insurance Certification | $0 | $0-$50/year | High-net-worth individuals, often requiring $1M+ net worth |

So, what does this all mean for you? There are other options out there, but they often mean you need a lot of cash on hand or have to meet some tough requirements. That’s why for most folks, a traditional non owner SR22 insurance policy just makes more sense. It’s the simplest and most affordable way to get back on the road. It gets the job done and meets the state’s rules without you having to lock away thousands of dollars. And that’s what we’re here to help you with – finding that simple, affordable solution that works for you.

Your Smart Money Checklist for SR-22

Putting it all together, here’s a simple checklist to help you handle your SR-22 in the smartest way possible –

✅ Look at the big picture cost, not just the monthly payment

✅ Ask if you can get a tax break if you ever drive for business

✅ Choose payment methods that can help your credit score

✅ Check for savings by bundling all your insurance policies together

✅ See if other options, like putting up a bond, make sense for you

✅ Keep an eye on your official end date

How Magnum Insurance Makes It All Easier

Navigating the world of non owner SR22 insurance can feel complex, but one of the biggest and most immediate worries for many people is simple: “How am I going to pay for this?” Managing cash flow and making sure your payments are on time is critical, because a missed payment can cause major setbacks. This is where the right insurance partner can make a world of difference. At Magnum Insurance, we understand that life can be unpredictable, and so are finances. That’s why we were founded in 1981 with a mission to provide not just better prices, but better service.

Flexible Payments for Your Peace of Mind

We solve your biggest payment problem by offering flexibility. We know that not everyone wants to pay with a credit card or automatic bank draft. You need options that fit your life. That’s why we offer various convenient ways to pay, including installments and financing options. You can pay with a credit or debit card, online, through our app, or even with cash at one of our local offices. This flexibility is at the heart of how we help. We work with people from all walks of life and with all kinds of credit histories.

A Local Partner You Can Trust

This commitment to service is what sets us apart. Magnum isn’t just a faceless website. You get a team of knowledgeable and trustworthy agents who live and work in your communities across Illinois, Indiana, Texas, Arizona, New Mexico, and Nevada. Our purpose is to be your helpful guide and reassuring expert. When you have a question about your SR-22, you can call us and talk to a real person who cares.

Final Thoughts

Getting an SR-22 requirement can feel like a big deal, but we hope you see that understanding the non owner SR22 insurance cost doesn’t have to be a scary or confusing process. It’s a bump in the road, but one you can get over with the right help.

The most important thing to remember is this: you don’t have to figure this all out on your own. You shouldn’t have to sort through complicated rules for SR-22 car insurance or worry about whether your SR22 auto insurance is set up correctly.

That’s what we’re here for. If you’re wondering what non-owner SR-22 insurance is and how much it could save you, you’ve come to the right place. From finding the right SR22 insurance quote to offering flexible ways to pay, our team is here to give you peace of mind. For over 40 years, we’ve been helping families protect what matters most. We believe protecting your future shouldn’t be complicated. It should be Magnum Insurance simple.