Business Insurance Calculator to Get You Started & What You Need to Know Beyond The Calculation

Use our business insurance calculator to get an idea of what you could expect from your premium. Keep in mind – it’s an estimate, not a guarantee, and we offer the most affordable policies! Get in touch with one of our business insurance reps for more and be on your way to insurance that doesn’t break the bank or cut corners!

Business Insurance Calculator

Looking to give your business iron-clad protection no matter what comes your way? Well, you’ve come to the right place! While you can’t predict what’s just around the corner, you can do everything to help safeguard the business you’ve worked hard to build.

Put simply, covering your business against losses and unexpected events is extremely important. In fact, it’s non-negotiable! After all, what if something drastic happens and you lose everything you’ve worked so hard for?

It might seem like a no-brainer, but you’d be surprised at the number of businesses that don’t have decent insurance, or any at all. Even with easy-to-use business insurance calculators like the one above, they’re still missing something vital.

In fact, here’s a jaw-dropping statistic for you: According to a 2023 report, 75% of small US businesses are underinsured. That means a claim may result in little or no payout,depending on the issue.

We get it, insurance might be something you avoid thinking about because it’s confusing or just a bit, well…dull. The good news is that we can demystify the whole thing and make it a lot easier. It’s really easy to enroll in a business insurance policy that fails to meet your actual coverage needs. Sometimes, cheaper isn’t always better, but of course you don’t want to bankrupt yourself in the process either. It’s all about balance.

But don’t worry! At Magnum Insurance, we’re here to help you untangle the complicated web – start by using our business insurance calculator above, then join us as we dig deeper to learn more.

Table of Contents

- TL;DR

- What Does Human Behavior and Calculator Design Have in Common?

- The Hidden Costs Most Calculators Miss

- Let’s Talk Strategic Implementation

- You Must Comply With Regulations, But What About Your Insurance?

- Final Thoughts

TL;DR

- Business insurance calculators use psychological triggers and default numbers to influence your coverage decisions, often steering you toward decisions that benefit the insurer only.

- Most calculators miss important details, such as vulnerabilities in your supply chain, remote work risks, and revenue model impacts. All of this can leave you with dangerous coverage gaps.

- AI and machine learning are transforming calculators into dynamic platforms that continuously adapt to real-time business conditions and predict future claims.

- Regulatory compliance requirements vary dramatically by state and industry, creating insurance needs that standard calculators consistently underestimate or ignore.

What Does Human Behavior and Calculator Design Have in Common?

What do you think when you hear the word ‘calculator’? Probably a basic tool that just adds together numbers and gives you an answer. That’s far from the mark! Today’s most sophisticated business insurance calculators don’t only deal with math. They take psychological biases and behaviors into account, giving you detailed information you can use to make stronger insurance decisions.

Let’s say it’s a tool for not only ideas, but solid guidance too. You might wonder why you need to use one in the first place. Well, it’s about giving you the very best options without creating serious insurance gaps that could have costly consequences. At Magnum Insurance, we’ve seen first hand the problems this can cause. We don’t want it to happen to you; that’s why we’re always around to help you out. We know tools like a business insurance calculator can seem daunting, but we’re going to talk you through what they do and how to make the most of them. Once you have your results, we can look through them together and search for the best policy for your needs.

What is Risk Anchoring?

When you’re doing anything related to numbers, something called risk anchoring comes into play, which is really important to understand if you’re going to use a calculator. This means that when you see the first numbers pop up on a calculator, your brain grabs hold of them. Then, it creates a reference point that influences your decisions moving forward. It’s all totally subconscious; you don’t realize it’s happening.

You might wonder why this is important. Well, understanding it means you have awareness. For instance, if you base a decision on a huge risk you think is likely to happen, you might ignore other ones. Maybe you think that you’re more likely to crash your car than experience a flood or theft. Is that true? No! It means you’re neglecting other potential risks. Instead, it’s important to take a step back and see the bigger picture, otherwise you’ll be over-insured in some areas and under-insured in others.

Default Value Manipulation

We get it – understanding the cost of business insurance can be complex and downright headache-inducing. There are many coverage types and levels, and it’s sometimes hard to know which is best for you. Remember, Magnum is on hand to help guide you through it. The first thing is to know that when you see a starting value on an insurance calculator, it’s not a random digit. It’s strategically chosen to help encourage you to choose a certain level of coverage.

It sounds manipulative, but when you think about it, it’s just marketing. These defaults are often chosen to protect the insurer’s profit margins or make sure that you get the best level of protection. Don’t always assume it’s the former! It all comes down to who built the calculator in the first place and what their motives are.

For that reason, always question your choice before finalizing it, but don’t push its advice aside. Remember, powerful algorithms have determined that outcome through analysis of your business data – it wasn’t picked out of the sky!

Easing The Mental Burden

Making decisions isn’t always easy, especially when it comes to your business. Have you heard about cognitive load? This basically means the amount of stress you put on your brain when you’re thinking and deciding something. The more stress, the harder it is to think straight and make a decision. The lower the stress, the easier the whole thing is.

We can also talk about decision paralysis. That’s when you just can’t make a decision because you don’t have a clue which way to turn, because the number of choices in front of you is just too much.

Modern insurance calculators understand all of this and they’re designed to make decisions around business insurance costs a little easier. One tactic is to use progressive disclosure techniques and smart defaults. It’s just a way to break the information down into easily digestible chunks, so it’s not so overwhelming. It helps you make decisions slowly and with the right information.

Loss Aversion Triggers

There are numerous cognitive traps we tend to fall into without even realizing it, and they all affect the choices we make. Another is loss aversion. As humans, we’re hardwired to focus on what we might lose first, over what we might gain. It’s a protection thing. For instance, you might hate the idea of losing a $20 bill more than actually finding one!

Many business insurance calculators use loss aversion triggers as part of their design. This means they highlight what you could lose if you choose a specific premium. For instance, the cheaper premiums are likely to highlight what isn’t covered, causing you to think twice and perhaps move toward a policy that’s a little pricier. They might also highlight what you could gain if you upgraded.

It’s a psychological trick used to tap into your natural tendency to fear losses. Don’t worry; you’re not alone! It’s a natural thing that all humans have. Yet, loss aversion triggers can be positive because they can lead to better coverage decisions.

Personalization is Always Best in Business

Source: pexel.com

When you ask for help or advice, you want to be sure that it’s for you only, right? You don’t want advice that’s for someone else; that’s not helpful to you. That’s why using a calculator such as this is a good idea – it gives you results that are tailored to your needs.

After all, generic answers won’t serve your business effectively; you want one that’s taken everything about your business into account. Perhaps you need personalized liability insurance, but your neighbor’s business only needs the basic form. Ultimately, every business is unique in its needs and preferences and you need information that’s tailored toward you and you alone. Modern calculators use a few different tactics to achieve that goal. Let’s look at some of them.

Making Predictions

The first is predictive risk modeling. This uses a sophisticated algorithm operating behind the scenes. It uses lots of different types of information to help create a risk profile just for you. What kind of information? Things like your business type and where it’s based, how big it is, and any problems you’ve faced in the past. From there, it’ll look at data from similar businesses and this helps it predict any future claims you might have, as well as how likely they are.

This information is very important because it gives you a far more accurate coverage level. It’s also a little like a crystal ball, giving you details that may not be immediately obvious. However, the key to getting the best results is giving the calculator as much information as possible.

Many business owners skip this step or don’t dig in as deep as they could. Don’t make that error! Be honest, give all data, and you’ll see much better results.

When Things Change

There are many things that can affect the costs of business insurance. We’re talking about real-time market conditions and trends, your competition, and seasonal risk changes. A sophisticated business insurance calculator takes all of this into account and gives you recommendations within minutes. From there, you can be sure that you’re covered across all situations.

Challenges With Integration

So far, we’ve talked about the huge amount of information that a small business insurance cost calculator uses to give coverage recommendations. But that’s not all. These tools can also integrate into your existing business systems. We’re talking about your accounting software, business intelligence platforms, and your HR systems.

You might wonder why it needs to do that. Well, it just means that it can automatically pull in accurate data like revenue or employee count. In the end, you get a more tailored and accurate insurance estimate because everything is based on your actual business operations.

At Magnum, when we’re looking for insurance deals for you, we need the most up-to-date, detailed information you can give us. That’s how we find tailored solutions that meet your specific requirements. It’s the same idea when you’re using a calculator.

The Hidden Costs Most Calculators Miss

Are business insurance calculators perfect? Of course not! Nothing is. Technology has accelerated rapidly over the last few years. It’s amazing and terrifying all at the same time. Yet, all of this creates opportunities, especially when it comes to spotting hidden costs.

The earliest insurance calculators did their job at the time, but they focused on the basics. These days, sophisticated calculators need to think about all the hidden extras that we face in the modern age – and it’s a lot, right? This includes things like operational quirks, business models, and the regulatory landscape. These are all small things that standard tools overlook, causing blind spots that can lead to cover gaps, or paying too much. And let’s be honest, nobody wants either of those things.

To explain this more, the table below gives some key details about cost variables and how standard calculators approached this. You can clearly see the potential coverage gaps they overlooked. It definitely shows how much better modern calculators really are!

| Cost Variable Category | Standard Calculator Approach | Reality Impact | Coverage Gap Risk |

| Supply Chain Dependencies | Generic industry risk factors | Single-source supplier failure can halt operations | 60-80% underinsured for business interruption |

| Remote Work Arrangements | Traditional office-based calculations | Home office injuries, cyber vulnerabilities | Workers’ comp and cyber liability gaps |

| Revenue Model Timing | Annual revenue averages | Seasonal cash flow, project payment delays | Business interruption timing mismatches |

| Regulatory Compliance | Static industry requirements | Evolving privacy laws, environmental standards | Professional liability and regulatory fines |

All Businesses Are Different

If only it were as simple as saying that businesses sell goods and services and receive money for them. These days, there are many different business models, and the whole situation gets more complicated by the moment. So, whether your business is subscription-based, uses project-based billing, or you have seasonal variations, you’ll need insurance that covers your particular format.

We know that it can be a little overwhelming when you’re trying to pull together all the information to find an insurance quote. It’s a lot, we know. But remember, if you have any questions, you can always reach out and contact us at Magnum. Remember, we actually want to help!

Cash Flow Timing Vulnerabilities

Maybe your business is seasonal, such as the travel industry. In that case, you have an irregular cash flow because it’s heavier at some times compared to others. So, what do you do during the quieter times? That’s where business interruption insurance comes into play. But before you grab your card and start purchasing coverage, you need to pinpoint the times when you’ll need more coverage than others.

The checklist below gives you some key advice on what you need to do while considering your insurance options:

Pre-Assessment Checklist:

- Document your peak revenue months and seasonal patterns

- Calculate average time between project completion and payment

- Identify your largest customers and their payment terms

- Assess cash flow gaps during typical business cycles

- Review accounts receivable aging patterns

- Determine minimum cash flow needed to maintain operations

Let’s Talk About Implementation

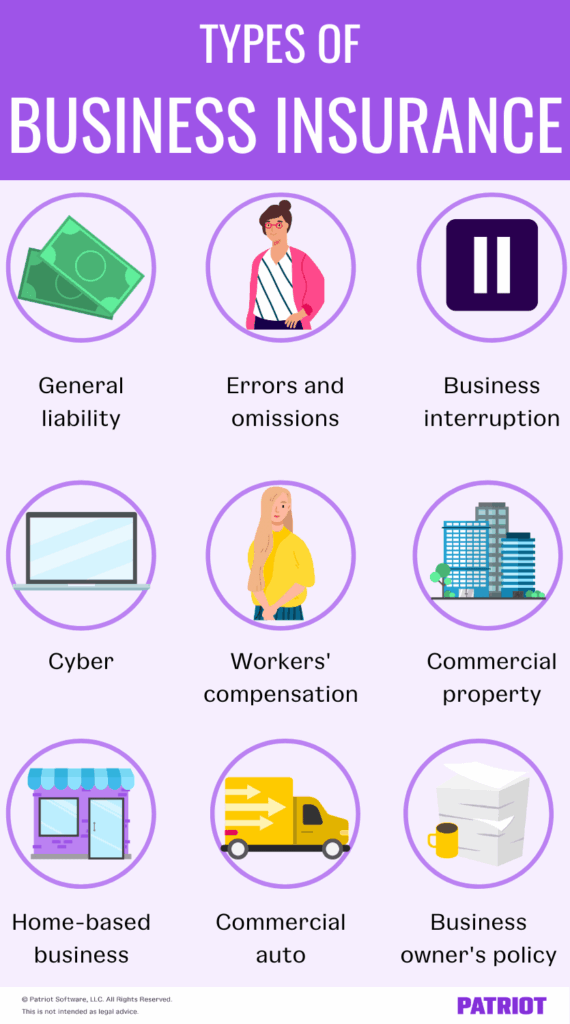

Source: patriotsoftware.com

Okay, you’ve done a quick check and you know that you need insurance. What’s your next question? Probably: how much is business insurance? By this point, you’ve probably realized that it depends heavily on many factors. One of those is how you implement a business insurance calculator from the get-go and use it to give you a general idea of costs.

The most successful use of this tool is when you truly understand your business’ unique risk profile. And every business has one – even those that claim they don’t! Yet, it’s also important to know that calculators don’t have crystal balls, at least not yet. That means they have limitations, and it’s a good idea to have a validation strategy place that combines tools and expertise. This means you can check that it’s working properly and not just giving you random information that’s far from useful.

The Pre-Calculation Business Assessment

Before you even start using a business insurance cost calculator, you should conduct a full risk assessment. Remember, the more you put into your calculator, the more you’ll get out of it.

When you’re looking at what to document, notice your critical business functions. These are the things that you can’t do without, and it includes the people that play a big part in your business, as well as vendors, and any technology you can’t do without. This will help you spot any potential coverage gaps that a regular calculator might miss. For instance, maybe you need a specialized form of commercial insurance, but your calculator doesn’t highlight it.

Check out this template to help you understand what to look at:

Operational Dependency Assessment Template:

Critical Personnel:

- List key individuals whose absence would halt operations

- Identify specialized skills that are difficult to replace

- Document succession plans for critical roles

Essential Vendors:

- Map all suppliers and their criticality to operations

- Assess geographic concentration of key suppliers

- Review backup supplier arrangements

Technology Dependencies:

- Inventory all critical software and systems

- Assess single points of failure in your tech stack

- Document data backup and recovery procedures

Revenue Stream Risk Analysis

Maybe you have multiple income streams, Lucky you! In that case, look at each one and figure out your risk profile of each. Again, this will help spot coverage gaps and give you a more accurate cost of business insurance.

Growth Trajectory Planning

When you’re looking at potential small business insurance cost, it’s important to consider not just today, but tomorrow too. Where will your business be in the next few years? What might change? In many cases, insurance coverage tends to lag behind your business growth, but this can cause dangerous gaps as you grow. So, grab your metaphorical crystal ball and look ahead to prevent these shortfalls.

Checking Your Results

When you ask for advice, you probably ask more than one person, right? Or, when you go to the doctor and you’re not totally convinced about their diagnosis, you might ask for a second opinion. That’s called validation; you’re basically checking your results, and it’s a good idea to do the same with your calculator results. That way, you know you’re getting the best information possible.

The reason isn’t because you can’t rely on the one you’ve chosen. Far from it! It’s because all calculators have strengths and biases. Yes, even technology has biases!

If you’re not sure where to start with this, the table below will shed some light on the whole thing.

| Calculator Type | Strengths | Limitations | Best Use Case |

| Insurance Carrier Tools | Accurate pricing for specific products | Limited to carrier’s offerings | Getting realistic quotes from preferred insurers |

| Independent Brokers | Broad market perspective | May lack real-time pricing | Comparing coverage options across multiple carriers |

| Industry-Specific | Understands sector risks | Limited carrier partnerships | Identifying specialized coverage needs |

| Generic Business | Quick baseline estimates | Misses industry nuances | Initial risk assessment and education |

You Must Comply With Regulations, But What About Your Insurance?

There are bound to be some parts of your business that are a little on the complex side. After all, running a business isn’t easy. Some small business insurance cost calculators might not be able to handle those complications quite so well, especially if we’re talking about regulations. Yes, those things that give you a headache but you can’t avoid. These can range from local to state, and even federal requirements, and they can impact your coverage needs and final costs.

The problem is that this can lead to blind spots and can cause a gap between what your calculator estimates and what you actually need.

At Magnum Insurance, we’re experts in this situation. We’ve helped so many businesses over the years, and they’ve all had their own quirks and different rules they need to follow. That’s why we tailor our services to your specific needs and ask for all the information before we start. That way, you can trust the end result. And that’s the most important thing in the end. So, if regulatory compliance and insurance confuse you, don’t hesitate to reach out.

When Several States Are Involved

If you do business over state lines, you’ll have far more complex insurance needs than a local business that sticks with domestic customers. In that case, a single-state calculator isn’t going to cut the mustard. Instead, you need to look at each state’s requirements in detail, and then consider your coverage needs from that information. Otherwise, you run the risk of failure to comply, and that causes a whole world of drastic consequences you definitely don’t need.

Professional Liability Differences

There’s something else to think about, and that’s the differences between licensing requirements and liability standards. Sure, they’re both rules you need to adhere to without any question, but they often vary massively between states, especially for service-based business. Again, this can lead to more detailed coverage needs that a regular calculator just won’t handle.

The answer? A professional consultation to make sure that you don’t miss anything important. Check out the list below to give you more actionable advice:

Regulatory Compliance Checklist:

- Research state-specific insurance requirements for each operating jurisdiction

- Review industry professional licensing and certification requirements

- Assess data privacy law compliance needs (GDPR, CCPA, state laws)

- Evaluate environmental regulations affecting your industry

- Check professional association standards and requirements

- Review local business licensing and insurance mandates

Final Thoughts

Source: Magnum Insurance

The world is unpredictable, sometimes a little strange, and often quite chaotic. Anything can happen at any time, and do you know what? Insurance is a must-have. There’s just no way around it. Yet, there’s no denying that it’s not the easiest topic in the world to understand, especially if you’re searching for the first time. If you’re nodding along, please don’t worry. You’re not the first to find this confusing, and you’re definitely not going to be the last! There’s a reason we exist – because so many people like you need advice on this subject, and we’re just the people to help.

A business insurance calculator is a great tool to help you estimate the type of coverage you need, and how much. Whether you need standard business cover, cargo van insurance, or something else entirely, you’ll have greater insights with technology such as this.

Not only does an insurance calculator tell you about your coverage needs but it gives you rough costs of business insurance. You’ll no doubt know that budgeting is key in business, and this information will help you do just that. But remember that there’s no magic at play here; even the most sophisticated calculators can miss things. Much of it depends on your input, so do a full risk assessment before you start. That way, you’ll give it more to work with.

Now, you might wonder why you should use a calculator in the first place. After all this information, what’s the point? Well it’s a good point, really. A business insurance calculator helps you plan. It gives you information that you can use to figure things out and move forward. But remember, it doesn’t replace the human touch. At Magnum, we can help you take your calculator results and turn them into solid, real insurance premiums. Not only that, but premiums that suit your budget and cover your business properly.

Think of us as your helpful guides through the confusing yet always important world of insurance. We have over 40 years of experience, so we know what we’re talking about! And we’re on hand to demystify insurance and make it far easier to understand. Whatever your question, we can help, and we’ll immediately get to work finding the best solution for your situation.

We’re all about simplifying, and that extends to payments too. We offer payment flexibility with installments and financing options. In the end, why should insurance be a complex subject when it does the easiest thing in the world – protect? No matter your situation, we’ll do what we can to help. So, reach out to us today and let’s see what’s possible!

Quote Business Insurance online or give us a call

- Choose the right insurance

- Business Insurance

- Business Owner’s Policy

- Commercial Auto

- Commercial Property

- General Liability

- Life Insurance

- MIA Dental Insurance

- MIA Vision Insurance

- Professional Liability

- Surety Bonds

- Workers Compensation

- Select state

- Arizona

- Illinois

- Indiana

- Nevada

- New Mexico

- Texas