Rideshare Insurance Cost: Protect Your Driving Income the Simple Way

If you drive for Uber or Lyft, you know the money is great. But have you thought about what happens if you crash? Your regular auto insurance might not cover you at all. This guide is here to help. We’ll break down the rideshare insurance cost and show you how to protect your income without overpaying. Choose the right insurance for your business, not just your driving gig. We’re here to give you the support you need every mile of the way. Let’s get started:

Table of Contents

- Why Your Regular Car Insurance Won’t Cut It

- The Real Cost Breakdown: What You’ll Actually Pay

- Coverage Options That Won’t Break Your Budget

- Major Insurance Companies and Their Rideshare Deals

- Smart Shopping: Getting Quotes and Making Decisions

- Money-Saving Strategies

- How Magnum Insurance Can Help

- Final Thoughts

TL;DR

Here’s the quick scoop on your rideshare insurance cost and why you can’t skip it:

- Your Regular Car Insurance Won’t Cut It: Once you turn the app on, your personal auto insurance policy sees you as working. It’ll say “Nope” to covering any wreck you have

- The Scary Gap: You’re least protected in “Period 1”, app on, waiting for a request. The rideshare companies offer very little coverage here. You’d pay for everything out-of-pocket. That’s a huge financial risk

- Two Simple Options:

- Rideshare Endorsement: The cheapest way to cover the gap. It’s just a small addition to your current policy. This is the budget champion for part-time drivers

- Standalone Policy: A separate policy for full-time drivers. It costs more but gives you the best, full protection your income needs

- Smart Shopping Saves Cash: Get quotes! Don’t just look at the monthly bill, check deductibles and coverage limits. Calculating your total yearly rideshare insurance cost is the smart move

- We’ve Got Your Back: Magnum Insurance makes it easy to find the right coverage balance. We’re here to help you protect your income without overpaying. Don’t let your liability insurance cost stress you out. We’re your trusted, helpful guide

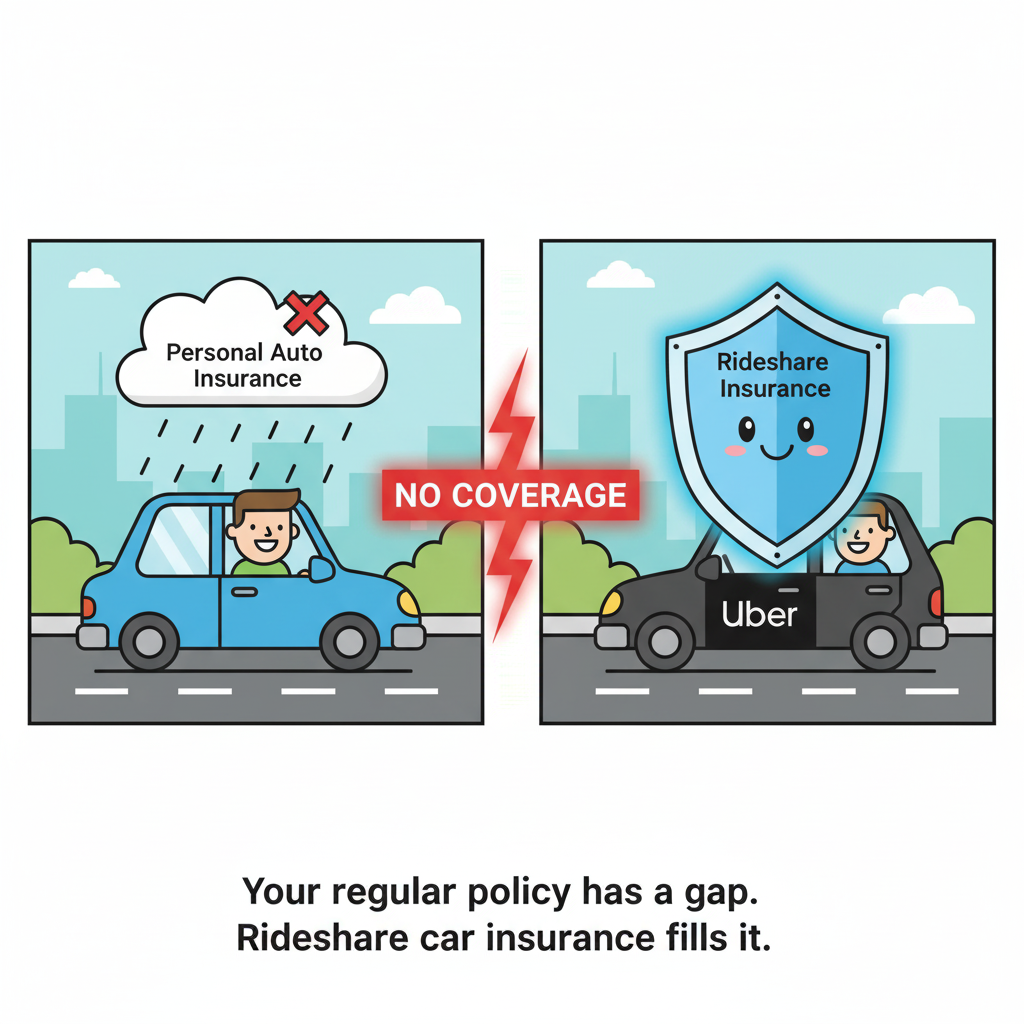

Why Your Regular Car Insurance Won’t Cut It for Rideshare

Most drivers don’t realize their personal car insurance for rideshare drivers is useless. This is true the second they turn on the app. If you’ve ever wondered just what car insurance covers in an accident, the answer is often “not this” when you’re working. This creates a dangerous gap in your coverage. Standard policies specifically say no to commercial driving. This leaves you exposed to big financial losses during an accident.

Source: AI Generated

The Coverage Gap That Could Cost You Everything

It’s super-important to avoid stress while driving, and knowing you’re covered helps a ton. Your personal rideshare car insurance policy has strict rules. These rules say no to commercial use. This means your coverage can be denied entirely. It happens if you’re in a crash while driving for Uber or Lyft. Understanding these gaps is vital for your wallet. It protects your money. If you get into a wreck during this time, you could be stuck paying for all the damage yourself.

When Your Personal Policy Says “Nope”

Insurance companies see rideshare driving as work. Most personal policies specifically exclude coverage during these activities. You could be denied coverage even if you’re just sitting in a parking lot. This happens while you wait for a ride request.

Your insurance company doesn’t care if you’ve been a loyal customer for years. The moment they discover you were using your car for rideshare during an accident, they can legally deny your claim. That’s why rideshare car insurance is now a must for anyone driving for these platforms.

The Three Phases Every Driver Needs to Understand

Rideshare driving splits your day into three time frames. Each one has different insurance rules. You must know these periods. Your money situation depends on it.

Here are the three phases:

- Offline: You’re just driving your car. You’re using it for personal trips. Your regular auto insurance covers you fully here

- Period 1: You’ve turned the app on. Now you’re waiting for a ride request

- Periods 2 & 3: You’re driving to pick up a passenger. Or you have a passenger in your vehicle

Period 1 is the riskiest time for your wallet. It’s the huge insurance gap. You’re online, so your personal policy won’t cover you. They see you as working now. But you haven’t accepted a ride yet. This means the rideshare companies give you very little protection. If you crash during Period 1, you could be left totally alone. Auto insurance for rideshare drivers must cover all three phases. This gives you complete, reliable protection.

The Financial Nightmare Without Proper Coverage

Not that we’d wish this on anyone, but, let’s say you’re in a wreck. Without the right Rideshare insurance, you pay for everything. This includes car repairs. It includes medical bills. It includes liability claims that can be huge.

Your rideshare earnings won’t make a dent in those costs. The unexpected can happen at any moment. You’ve got to be prepared. The math is simple. One major accident can create massive debt.

What Uber and Lyft Actually Cover (Spoiler: It’s Not Enough)

Yes, rideshare companies offer some insurance. But their policies have limits. They often have high deductibles. These gaps leave you responsible for big costs during certain driving phases.

For instance, Uber’s coverage during Period 1 has a very high deductible for comprehensive and collision. If someone hits your car while you wait, you pay a lot out of pocket first. Most drivers don’t have that cash ready. Thinking about your total coverage needs? A commercial insurance calculator might give you a better picture of the costs.

The Real Cost Breakdown: What You’ll Actually Pay

Rideshare insurance cost varies a lot. It changes based on where you live and on how much you drive. Your car type matters, too. The math here is simple. It’s an easy choice to protect your driving income. The risk of having to pay for a huge claim yourself far outweighs the cost of the policy. You might also be wondering about something like cargo van insurance costs if you’re in the delivery business, but for rideshare, a simple add-on is usually the fix. This next section gives you honest expectations about the cost of rideshare insurance.

Geographic Reality Check: Location Matters More Than You Think

Where you drive changes your premium. If you’re driving in a big city, expect to pay more. Cities have higher accident rates. They have more theft. Rural areas might have lower costs. That’s because the risk is lower. The cost of rideshare insurance can be very different. It depends only on your zip code.

How Much You Drive Actually Affects Your Rates

How often you drive for rideshare affects your rate. Part-time drivers usually pay less. Full-time drivers spend more time on the road. They accumulate more miles. This means higher premiums. If you’re logging a lot of hours weekly, expect higher pricing.

Breaking Down the Real Numbers

Rideshare insurance costs can be cheap. Endorsements only add a small amount to your monthly bill. Standalone policies cost more. They give you the full package.

What You’ll Pay Monthly (The Honest Truth)

Your cheapest option is a rideshare insurance endorsement. This is a simple add-on for your current policy. It only costs a small amount extra each month. It’s the most budget-friendly choice available.

If you drive full-time, a standalone rideshare insurance policy is a better fit. These policies start at a higher rate. They give you the best, full-time protection. They are more expensive because they cover all your hours on the road. If you need the maximum coverage, these separate plans will cost you more. But they give you real security for your income.

Hidden Costs They Don’t Advertise

Watch out for fees. Insurance companies may charge fees for processing. They might charge policy change fees. And they might also require higher liability limits. This increases your total cost. Some insurers require higher liability limits instead of the state minimums. This can raise your costs quickly.

Is It Worth It?

The cost of having the right coverage is very small. It’s small when you think about the risk. One accident without coverage could wipe out years of your earnings. It can create huge, crushing bills.

Paying a small amount each month for protection is smart. It keeps your business safe. The math here is simple. It’s an easy choice to protect your driving income.

Source: AI Generated

Coverage Options That Won’t Break Your Budget

You have choices here. You don’t have to choose the most expensive plan. We’ll show you two main paths. You can pick the one that makes the most sense for your schedule and your wallet. Each option offers different levels of protection. You can find a solution that fits your budget easily.

Rideshare Endorsements: The Budget-Friendly Option

As mentioned, this is the cheapest way to get covered. It’s just a simple addition to your current policy. We’ll explain how these small add-ons work.

How These Actually Work

Think of endorsements as insurance that knows you’re working. They automatically activate when you turn on your rideshare app. They turn off when you go offline. No switching between policies is needed. A rideshare insurance endorsement closes the gap. It links your personal coverage to your work needs.

Endorsement vs. Separate Policy: The Cost Reality

Endorsements add a percentage to your current premium. This makes them much cheaper than a standalone commercial policy. They provide enough protection for most drivers.

Standalone Policies: When You Need the Full Package

This is a separate rideshare insurance policy you buy. It is usually for drivers who spend a lot of time on the road.

When Going Solo Makes Financial Sense

Full-time drivers should look at standalone policies. This is the right choice if rideshare is your main income. Your car is your job. This means you need the best protection.

These policies come with extra features. They may offer rental car coverage during repairs. If your car is in the shop after a crash, you need a ride. This coverage helps you get a rental. This means you can keep driving. You can keep earning money right away. A rideshare insurance policy is vital when your income depends on driving every day. It’s built to keep you on the road and working.

Major Insurance Companies and Their Rideshare Deals

Many big names offer different rideshare car insurance products. They all have different prices and options. Since independent insurance agents are here to help, knowing what these companies offer helps us find your best deal.

Progressive: The Rideshare Pioneer

Progressive rideshare insurance was one of the first options available. They have many choices. They use both endorsements and separate policies. Their prices are very competitive.

Progressive fills the gaps that Uber and Lyft leave behind. Their protection starts right in Period 1. That’s when you’re waiting for rides. They can offer lower deductibles than the rideshare companies do. Progressive rideshare insurance is a quality standard.

State Farm: The Traditional Approach

State Farm rideshare insurance keeps things simple. They use endorsements that easily link with your current policy. They give solid protection for drivers who only work sometimes. Their local agent network is a big benefit.

State Farm rideshare insurance just extends your current coverage to your rideshare work. Your deductibles stay the same. Your coverage limits stay consistent. You work with the same agent you know. No need to learn new systems.

The Agent Advantage

Never forget that there’s a difference between captive agents and independent agents when it comes to insurance. That’s why having a local agent like us is a huge help when you file a claim. This is because we know you. We understand rideshare coverage and walk you through the process. You’re not stuck on hold with a call center.

The Up-and-Comers Worth Watching

Newer companies are creating smart rideshare car insurance solutions, too. These may offer better prices and features just for specific types of drivers.

Regional insurers often know local markets better. They can sometimes beat big national companies on price. A local carrier in Texas might offer better rates than a national company trying to cover the entire country.

Newer companies use technology. They offer pay-per-mile options. This can be cheaper for occasional drivers. If you only drive on weekends, why pay for full-time protection? These companies are always changing rideshare insurance cost options.

Smart Shopping: Getting Quotes and Making Decisions

You need accurate rideshare insurance quotes. This is because you have to compare different choices. Car insurance for rideshare drivers must balance being something you can afford along with protection. It’s just like any other business expense, whether you’re dealing with it or need handyman insurance cost for a side hustle. Getting the balance right is key.

The Quote Process: What You Need to Know

Getting rideshare auto insurance quotes requires detailed information. Insurers need to understand the extra risk. They need to know your usage patterns.

Expect detailed questions about your rideshare work. How many hours do you drive weekly? Which platforms do you use? Be honest. Lying on applications can void your coverage later. Getting an accurate rideshare insurance quote requires complete transparency.

The Smart Way to Shop Around

Start with your current insurer. Adding an rideshare insurance endorsement is often cheapest. Then get quotes from at least three other companies. Don’t just compare prices. Look at deductibles. Look at coverage limits and at the claims process. The cheapest option might cost you more later.

Making the Right Choice for Your Situation

Choosing the right auto insurance for rideshare drivers means balancing two things. It means balancing the cost and the coverage. Look at deductibles, at coverage limits and at the extra benefits.

Calculate your total yearly cost. Don’t just look at the monthly premium. You need to know how much rideshare insurance cost you can handle. Plus, you’ll need to protect your income. Car insurance for rideshare drivers must balance affordability with protection.

Money-Saving Strategies

Smart drivers can really reduce their insurance bills. You can save money through bundling. You can save money through usage-based programs. These steps help you keep good protection and keep more money in your pocket.

Bundling and Multi-Policy Discounts That Actually Work

Bundling is easy. It saves money. Bundling your rideshare insurance with home or renters insurance saves money. It can offset the added rideshare insurance cost. Even a small renters policy can unlock big auto insurance savings.

If you have other vehicles, consolidate your policies. This often gives you better rates. This strategy reduces the overall cost of rideshare insurance for your entire household.

Usage-Based Programs for Part-Time Drivers

If you drive rideshare part-time, these programs can save you money. This is because they track your actual driving time and mileage. No doubt, this is much cheaper than a full-time policy.

Pay-per-mile insurance makes sense. You only pay a small base rate. Then you pay a fee per mile. This can cut costs for weekend drivers. Telematics programs also reward safe driving. If you’re a careful driver, you’ll see savings. An rideshare insurance endorsement plus a telematics program is a smart move.

Timing Your Coverage Changes Strategically

You can adjust your coverage based on when you drive. If you only drive during busy periods like holidays, some insurers allow temporary changes. Just be careful. Make sure you don’t create gaps that void your coverage.

Policy renewal time is perfect for shopping. Your current insurer might not offer the best rates later. This is true if your driving has changed. Strategic timing can help you secure better rideshare insurance endorsement rates.

How Magnum Insurance Can Help

Magnum Insurance has been in the game for over 40 years. We know drivers need affordable solutions. We help you with the rideshare insurance cost, provide better prices on complete coverage, and help drivers with the biggest issues they face. This is true for people in many states. Indubitably, commercial auto insurance in Arizona, Nevada, Illinois, Indiana, New Mexico, and Texas are some of the many things we handle every day.

Our local agents give you personal help. They understand what rideshare driving involves. They explain options simply. Whether you need a simple rideshare insurance endorsement or a full standalone policy, we guide you. We find the right fit for you.

Our mobile app and online tools help busy drivers. You get insurance cards fast. You report claims quickly. You manage payments without interrupting your driving. Cash payment options are available. We know our customers need flexible ways to pay.

Ready to protect your rideshare income? Get a personalized quote from Magnum Insurance by calling today. Find out how proper coverage can actually save you money.

Final Thoughts

Managing your rideshare insurance cost is just smart business. You can’t control the big picture problems. But you can absolutely control a few things. You control your safety plan. You control your coverage choices. And you control how you shop for insurance.

The people who win are the ones who look at insurance the smart way. They keep safety first. They talk to knowledgeable agents. This helps them get lower prices. No matter what, you’ve got to keep your kids safe, your riders, and your property protected.

Remember, the cheapest policy isn’t always the best value. Focus on getting the right protection for your life. This helps support your business goals, too. When it comes to something like general liability vs professional liability or figuring out your personal rideshare insurance cost, at Magnum, we’ve got your back.