How Does SR-22 Insurance Work: A Clear Guide to Getting Back on the Road

Hearing the term “SR-22” can be confusing and, honestly, a little stressful. It sounds official, complicated, and like something you’d rather not have on your plate. If you’re feeling overwhelmed, that’s completely normal. Most people have never heard of it until the day they’re told they need one. You’re likely trying to figure out the question – how does SR-22 insurance work, and what it means for your future.

Take a deep breath.

The good news is that an SR-22 isn’t nearly as scary as it sounds – and you absolutely can handle this. Our goal with this guide is to walk you through everything, step by step, so you know exactly what to expect.

We get it. Driving isn’t just about getting from one place to another; it’s a huge responsibility. You already focus on important things like keeping your kids safe in the car, so dealing with a new insurance requirement on top of all that can feel like a heavy weight.

But you are not alone in this. At Magnum Insurance, we believe getting the right protection shouldn’t be complicated. Let’s walk through this together and show you how to handle an SR22 insurance requirement with confidence, so you can get back to focusing on what matters most.

Table of Contents

- TL;DR

- The Big Question: What Exactly Is an SR-22?

- Why Would I Need an SR-22 in the First Place?

- Which Type of SR-22 Is Right for You?: Owner vs. Non-Owner

- Your Step-by-Step Guide to Getting an SR-22

- The Money Talk: Understanding SR-22 Costs

- Tips for a Smooth SR-22 Journey

- What Happens if I Move to Another State?

- The Finish Line: Life After the SR-22

- You’re Not Alone – We’re Here to Help

TL;DR

- An SR-22 isn’t insurance. It’s a certificate your insurer files with the state to prove you have an active auto insurance policy.

- You’ll be notified by a court or the DMV if you need one, usually after an incident like a DUI or driving without insurance.

- The key to a successful SR-22 period is keeping your insurance policy active without any gaps. Missing a payment can lead to immediate license suspension.

- While your insurance rates will likely increase, this is temporary. Working with an independent agency like Magnum can help you find the most affordable option.

- After your required period (usually 3 years), the SR-22 is removed, and you can get back to lower, standard insurance rates.

Source: Magnum Insurance

Caption: An SR-22 isn’t an insurance policy itself, but a certificate that proves you’re insured.

Alt: Illustration of people looking at official documents, explaining what an SR-22 is.

The Big Question: What Exactly Is an SR-22?

First things first, let’s clear up the biggest misconception right away. An SR-22 is not a type of auto insurance. You can’t go out and “buy an SR-22 policy” because such a thing doesn’t exist.

An SR-22 is simply a certificate. It’s a form, usually a digital one, that your insurance company files on your behalf with your state’s Department of Motor Vehicles (DMV) or a similar agency.

So, what is the point of an SR-22?

Think of it as a formal line of communication between your insurance provider and the state. By filing the SR-22, your insurer is officially vouching for you. They’re telling the state: “We’ve got this person covered. They have an active insurance policy that meets the state’s minimum liability requirements, and we promise to notify you immediately if that coverage stops for any reason.”

That’s its entire job. It’s a certificate of financial responsibility. It proves to the state that you’re meeting your legal obligation to be an insured driver. It’s a way for you to show you’re taking this seriously and are safe to have on the road.

This certificate gets attached to a regular insurance policy, whether it’s for your car or a motorcycle insurance policy. You still have a normal policy; you just have this extra form filed in the background.

Why Would I Need an SR-22 in the First Place?

This is the question on everyone’s mind. People need an SR-22 for a handful of reasons, and they’re more common than you might think. A single mistake or a period of difficulty shouldn’t define your ability to get back on track and drive legally.

You won’t have to guess if you need one. A court or your state’s DMV will send you an official notice telling you it’s a requirement. This typically happens after certain driving-related incidents that flag you as needing extra monitoring.

Here are a few common scenarios that lead to an SR22 requirement –

Driving Under the Influence (DUI/DWI)

This is one of the most frequent triggers. After a DUI or DWI conviction, the state wants extra assurance that you have insurance before your driving privileges are restored. It’s a standard part of the process for getting back on the road.

Driving Without Insurance

Accidents and deaths on our roads happen. Although this is depressing to think about, the worst part is that many of these drivers didn’t have auto insurance that could cover the expense of the accident. If you were pulled over or involved in an accident and couldn’t provide proof of insurance, the state will almost certainly require an SR-22 to reinstate your license. It’s their way of making sure you’re covered from that point forward.

Serious or Repeated Traffic Offenses

One or two minor tickets usually won’t trigger this. But things like a reckless driving conviction, street racing, or accumulating too many points on your license in a short time can lead to an SR-22 requirement. It signals to the state that you’re a higher-risk driver.

At-Fault Accidents While Uninsured

If you cause an accident that results in injuries or property damage and you don’t have insurance to cover the costs, an SR-22 will be part of the path to getting your license back.

License Suspension or Revocation

If your license was suspended for other reasons (like failing to pay court-ordered judgments or other legal issues), you’ll likely need an SR-22 to prove you’re financially responsible before it’s reinstated.

No matter the reason, the path is the same. The SR-22 is a tool for demonstrating responsibility. With the right partner, it’s a completely manageable process.

Which Type of SR-22 Is Right for You?: Owner vs. Non-Owner

Just like there are different types of cars, an SR-22 filing can be matched to your specific situation. It’s not a one-size-fits-all deal. When you talk to an insurance agent, they’ll help you figure out exactly what you need. It usually comes down to one big question – Do you own the car you’ll be driving?

Owner SR-22

This is the most common type. If you own a vehicle and your name is on the title, you’ll get an Owner SR-22. It’s attached to your standard auto insurance policy that covers your car. It proves to the state that the vehicle you own and operate is properly insured. Simple as that. If you own multiple cars, the policy will cover them, and the SR-22 will be attached to that policy.

Source: Magnum Insurance

Non-Owner SR-22

This is an incredibly useful and often overlooked option. What if you don’t own a car? Maybe you sold it after your incident, or you just rely on public transportation and friends for now. But you still need to get your license back and want the ability to legally drive a borrowed or rented car.

This is where a Non-Owner SR-22 comes in.

A non-owner policy provides you with liability coverage whenever you’re behind the wheel of a vehicle you don’t own. By attaching an SR-22 to this policy, you can satisfy the state’s requirement without having a car in your name. This is often a much more affordable way to get back on the road. It keeps you legal without forcing you to buy and insure a vehicle.

This is also a fantastic strategy for protecting your family. If you live with parents or a spouse, adding an SR-22 to their policy can make their rates go way up. By getting your own, separate non-owner policy, you keep your requirement separate from their insurance, saving everyone money and stress.

Owner/Operator SR-22

This one is a bit of a hybrid. It’s less common but provides the broadest protection. It covers vehicles you own and any vehicles you may drive but don’t own. It’s designed for people whose driving situations are a bit more complex, like if you own a car but also frequently drive company vehicles. An experienced agent can help you decide if this is the right fit.

Your Step-by-Step Guide to Getting an SR-22

Okay, we’ve answered the question – what is an SR-22, and why you might need one. Now for the practical part – how do you actually get one? Let’s walk through the process. It’s easier than you’d expect.

Step 1 – Talk to an Insurance Agency That Can Help

So, you’ve just learned you need an SR-22. Your first instinct might be to call the insurance company you’ve been with for years. Unfortunately, you might be surprised by the answer you get. Here’s something most people don’t know – many of the big, national insurance companies just aren’t set up to handle SR-22 filings.

It’s nothing personal – they often prefer not to handle the extra administrative work. They might tell you they can’t help, or in some cases, even cancel your policy. Being turned away when you need help the most is a terrible feeling, but don’t worry. There is a much easier way.

This is where working with an independent agency like Magnum Insurance is a huge help.

It means we do all the legwork for you. Instead of you making a dozen stressful phone calls, you make one simple call to us. We’ll shop around to find a company that wants your business and offers a competitive rate for your SR22 insurance, taking that whole burden right off your shoulders.

Step 2 – We File the SR-22 for You

Once we’ve found the right policy for you, the hardest part is over. From there, we take over. Our team will promptly complete the official SR-22 certificate and file it electronically with the DMV on your behalf.

Because it’s all done online, the state gets the information quickly, which helps move the process along. Best of all, you won’t have to deal with long lines at the DMV or try to make sense of confusing government forms. We take care of all the paperwork so you can focus on everything else.

Step 3 – The State Gets the Message & You Get Your License Back

After the DMV receives and processes your SR-22 from us, they’re officially notified that you have met your insurance requirement. This is exactly what they need to move forward with reinstating your license. And just like that, the state knows you’ve got the insurance you need.

Step 4 – Keep Your Coverage Active (This is the Golden Rule!)

This is the most important part of the entire process. The SR-22 is your proof of continuous coverage. That means you cannot let your insurance policy lapse, not even for one day.

What many don’t think about is that the unexpected can happen at any moment. For that reason, you should always be prepared… If you miss a payment, your card expires, or your policy is canceled for any reason, your insurance company is legally required to notify the state immediately. They file another form, often called an SR-26, which tells the DMV your insurance is no longer active.

When that happens, the state will typically suspend your license again right away. There is no grace period. A simple administrative error can set you back significantly. This is why staying on top of your payments is non-negotiable for a stress-free compliance period.

The Money Talk: Understanding SR-22 Costs

Okay, let’s get to the question that’s probably on your mind – how much will this cost? The honest answer is that your insurance rate will probably go up for a while. After an incident that requires an SR-22, insurance companies simply see you as a higher risk, and that’s reflected in the price. But it’s helpful to see this as a temporary chapter, not the whole story.

The Filing Fee

First, there’s a one-time fee for filing the SR-22 certificate itself. This is a small administrative charge from the insurance carrier for getting the paperwork processed with the state. This fee is usually very affordable, typically around $15 to $50.

The Premium Increase

The main change you’ll notice to your budget will be the new price of your insurance premium. This new rate is based on your ‘high-risk’ status, but it also covers all the important work we do for you in the background – like handling the filing and keeping the state updated so your license stays active.

There’s also a potential cost you can easily avoid: a reinstatement fee from the state. This only happens if your policy accidentally lapses. It’s a completely avoidable expense and the biggest reason we always suggest setting up automatic payments. It’s the best way to protect yourself from extra fees and stress.

Of course, everyone’s situation is different, so the exact price of your premium will depend on a few things –

- The reason for the SR-22 – A more serious violation will have a bigger impact on your rate than a less serious one.

- Your overall driving history – Other recent tickets or accidents will also be factored in.

- Where you live – Each state has its own insurance rules and requirements.

- The car you drive – Just like with any policy, insuring a newer car typically costs more than an older one.

- The insurance company you choose – This is a big one, as rates can be very different from one company to the next.

That last point is where we can really help. We can’t change your driving record, but we can shop around with dozens of companies to find the one that offers you the best possible price. Our goal is to find a plan that fits your budget and takes the guesswork out of staying insured.

It’s helpful to see this as a passing phase. By keeping your policy active and driving safely, you’re proving you’re a responsible driver. Every single month is a step in the right direction – a step toward getting this behind you and back to lower rates.

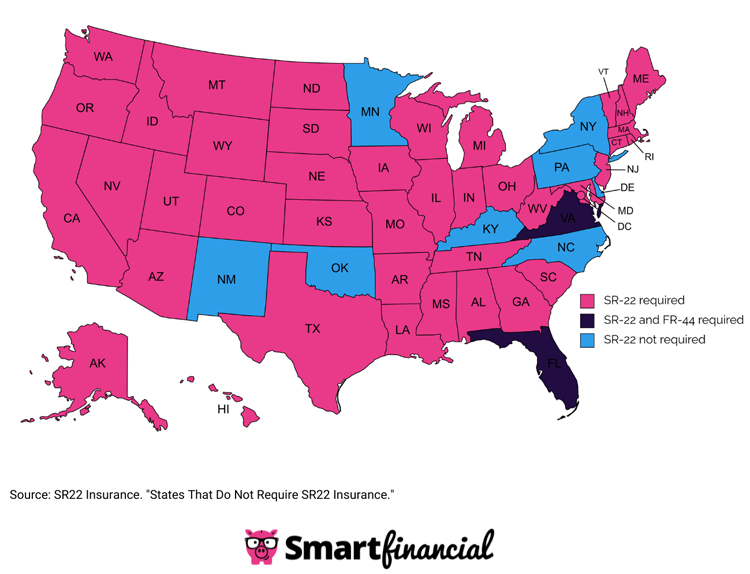

Source: smartfinancial.com

Do the Requirements Change Depending on Where I Live?

That’s a great question. The short answer is yes, the rules can be slightly different from state to state. The minimum amount of auto insurance coverage required in Texas, for example, might not be the same as what’s required in Nevada or Illinois. Sometimes, an SR-22 filing requires higher coverage limits than the normal state minimum, and sometimes it doesn’t.

But here’s the good news – You don’t have to worry about figuring this out on your own.

That’s what we’re here for. Our local agents are experts in your state’s specific laws. When you talk to us, we’ll handle all the details and make sure your policy has the exact amount of coverage you need to be fully legal and compliant. We make sure you’re protected, so you don’t have to become an expert in state regulations.

Tips for a Smooth SR-22 Journey

Being proactive is the key to managing the SR-22 process. It’s not about just letting it happen to you; it’s about taking control. Here are a few practical tips to help you through this period. It’s no secret that avoiding stress while driving is a must! That said, if you’re wondering things like “how does SR-22 insurance work to your advantage in these situations…”, then these tips are for you.

Act Quickly, But Don’t Panic

As soon as the court or DMV informs you of the requirement, start the process. The sooner you get your SR-22 filed, the sooner the clock starts ticking on your compliance period. Procrastinating only delays getting your license back. A quick call to us can get the ball rolling in minutes.

Why Automatic Payments Are So Important

If there’s one piece of advice we give everyone with an SR-22, it’s this – set up automatic payments. We mention it often because the biggest pitfall you can face is accidentally letting your policy lapse. A simple forgotten payment can lead to your license being suspended all over again, plus more fees and a lot of unnecessary stress.

Setting up automatic payments from your bank account or credit card is the single best way to make sure your coverage stays active without any gaps. It’s a simple step that gives you one less thing to worry about.

Drive Safely and Keep a Spotless Record

Think of this period as a chance for a fresh start. Every day you drive safely is a positive step forward, and it has a direct impact on your future insurance rates.

Here’s why – when your SR-22 requirement eventually ends (three years), other insurance companies will look at your recent driving record. A history clear of new tickets or accidents makes it easy for them to see you as a safe and responsible driver.

It’s truly the best way to help yourself. That clean record will be your ticket to getting the lowest possible rates when it’s time to leave the SR-22 behind and switch back to a standard policy.

Keep Your Documents Handy

It’s always a smart idea to keep your most current insurance ID card and a copy of your SR-22 certificate in your glove box. That way, if you’re ever pulled over, you can quickly show that you have the right coverage. Having everything in one place makes any interaction smoother and helps you avoid any extra hassle.

An Insider’s Tip for Future Savings

Here’s another way you can help yourself during this period. Many people don’t realize that insurance companies often look at credit scores when setting rates. A better score can lead to more affordable insurance options down the line. Taking small steps to improve your credit during your SR-22 period is a great way to set yourself up for the lowest possible rates in the future.

Your Simple SR-22 Success Checklist

Here’s a quick list of things you can do to make your SR-22 period as smooth as possible –

☐ Talk to Us About Filing Early – In some cases, filing your SR-22 before a court date can be helpful. Let’s discuss if this makes sense for you

☐ Set Up Auto-Pay – This is the #1 way to prevent a missed payment from causing a license suspension. Set it and forget it for total peace of mind

☐ Keep Your Driving Record Clean – Your safe driving habits are your best tool for getting lower rates when this is all over

☐ Have Your Documents Handy – Keep your proof of insurance and SR-22 certificate in your car so you’re always prepared

☐ Check In on Your Credit Score – A better credit score can lead to better insurance rates down the road. This is a great time to see where you stand and work on improvements

☐ Plan for the Finish Line – About a month before your SR-22 period ends, call us. We’ll start shopping for new, lower rates for you

☐ Chat with Us Before Making Changes – Thinking of changing your address or vehicle? Give us a call first. We’ll help you make sure any changes are reported correctly so you stay compliant

What Happens if I Move to Another State?

This is a common question, and it’s smart to ask it. You might have an SR-22 requirement in one state, but life happens – you get a great job offer or decide to move for family reasons. Does the SR-22 just disappear once you cross state lines?

The simple answer is that the SR-22 requirement does stay with you. Because states share driving record information with each other, you’ll need to complete the original requirement, no matter which state you live in. So, if you have a three-year requirement in Illinois and move to Nevada, you’ll still need to maintain the filing for the full three years.

But please don’t let that overwhelm you. This is a situation we handle all the time, and it’s much easier to manage than it sounds.

All you need to do is give us a call before you move. We’ll adjust your policy to make sure it meets the insurance requirements of your new state, all while keeping your SR-22 filing active with the original state. We handle all the behind-the-scenes details so you can focus on your move without any extra stress.

The Finish Line: Life After the SR-22

This is the best part. Your SR-22 requirement is not a life sentence. It’s a temporary period, and it will come to an end. Most states require it for three years, but this can vary. You can always check with your state’s DMV to confirm the exact length.

So, what happens when you finally cross that finish line?

- Confirm Your End Date

First, make sure you know the exact date your requirement period ends. The DMV is the official source for this information. Mark it on your calendar!

- Planning Ahead for Lower Rates

About 30-45 days before your SR-22 period is over, it’s time to be proactive. This is your moment to get back to the standard insurance market and secure much lower rates. This is the time to call us and say, “My SR-22 is almost done! Let’s find me a great new policy at a better price.”

- We Shop for You (Again!)

With your SR-22 period successfully completed and hopefully a clean driving record for the past few years, you are now a much more attractive customer to insurance companies. It means you can get back to the standard, more affordable insurance rates you deserve.

We will take your updated profile and once again shop the market for you. This time, we’ll be looking at standard carriers who offer the best rates, discounts, and coverage options. You’ll be amazed at how much your premiums can drop. We can also look at bundling your auto insurance with your renters’ insurance or homeowners’ insurance for even bigger savings.

- The SR-26 Filing

There’s one last piece of paperwork that happens behind the scenes, and it’s the one that makes everything official. Once your requirement period is over, we file a final form called an SR-26 with the state.

This form does the opposite of the first one. It tells the state that your SR-22 is no longer needed and the monitoring period has ended. It officially closes the loop, letting everyone know you’ve successfully completed the requirement.

And with that, it’s all done. You’re back to being a standard driver with more affordable insurance, and all the stress of the SR-22 can finally be left in the rearview mirror.

Your Checklist for Getting Lower Rates

You’ve done the hard work, so let’s make sure you get back to great, low-cost insurance. Here’s how to do it –

☐ Call Us 30 Days Before It Ends – This is the most important step! It gives us plenty of time to shop for the best rates for you

☐ Gather Your Completion Notice – Once you get official notice from the DMV that your SR-22 period is over, keep it handy

☐ Let Us Do the Heavy Lifting – You don’t need to research dozens of carriers. That’s our job. We’ll compare the top insurance companies and find the perfect policy for you – one without any SR-22 requirements

☐ Look for New Discounts – This is the perfect time to save even more. Ask us about bundling your new, lower-cost auto insurance with renters or homeowners insurance

☐ We’ll Ensure a Smooth Switch – We’ll help you time your new policy to start the exact moment it’s needed, ensuring you’re never without coverage. We handle the details so you can just enjoy the lower rate

Source: Magnum Insurance

You’re Not Alone – We’re Here to Help

We hope this guide has helped you understand and answer the question – how does SR-22 insurance work, and shown you that there’s a clear path forward. Our main goal is to take the confusion and stress out of the process, because you have more important things to focus on.

Whether you need an SR-22 in Illinois, Texas, Arizona, Nevada, New Mexico, or Indiana, we have local agents who understand your state’s specific rules. We’re here to be your helpful guide every step of the way.

And our commitment to you doesn’t end when your SR-22 does. We’ll be here long after to help you find great, affordable rates on everything else you care about. From standard auto insurance and motorcycle insurance to protecting your first apartment with renters insurance, our team will always do the shopping to find the right fit for you.If you have more questions or you’re ready to get started, just give us a call or request a quote online at Magnum Insurance today. Let’s talk it through and show you how simple getting protected can be.