A Clear Guide to Your Business Insurance Cost

Running a business is a huge accomplishment, and you pour your heart into it every day. You’re focused on serving your customers, managing your team, and planning for the future. Amid all that, thinking about your business insurance cost can feel like one more complicated item on a never-ending to-do list. You see a price on a quote, but you might wonder, “Is that the whole story? What am I really paying for?”

It’s a fair question, and you’re not alone in asking it. Insurance can seem like it has its own language, full of terms that don’t always make sense. But it doesn’t have to be that way. We believe understanding your insurance should be simple. Think of this as a straightforward chat where we show you what goes into your final bill. Maybe you have specific questions, like what’s behind box truck insurance cost secrets if you run a trucking business. Our goal is to give you clear answers so you can make smart decisions to protect the business you’ve worked so hard to build. Let’s get started –

Table of Contents

- TL;DR

- What’s Included in Your Business Insurance Policy?

- Why Every Business Has a Unique Insurance Price Tag

- Smarter Ways to Lower Your Insurance Bill

- Answering Your Top Business Insurance Questions

- Here’s How Magnum Makes Business Insurance Simple

- Final Thoughts

TL;DR

- Your business insurance bill is a mix of coverages that protect you from different problems, like property damage or accidents

- Your final business insurance cost is based on your unique business – what you do, where you’re located, and how many people are on your team

- You can lower your bill. Simple steps like having a safety plan or bundling policies can save you real money

- Big growth spurts can raise your rates. Planning for when you hire more people or hit new revenue goals helps you avoid surprise price hikes

- The right insurance partner makes it easy. They should understand your business and help you get the right coverage without the confusion

What’s Included in Your Business Insurance Policy?

Before we get into prices, let’s look at what you’re actually buying. Business insurance isn’t just one thing. It’s usually a package of different coverages.

Each coverage protects your business from a different type of problem. Once you know what these pieces are, it’s much easier to understand what you’re paying for and figure out how much business insurance you really need.

Here are some of the most common types of coverage that make up a business insurance policy –

General Liability Insurance

Think of this as your “oops” coverage. It protects you if a customer gets hurt at your business, or if you accidentally damage someone’s property. For example, it helps pay the medical or repair bills if a customer slips on a wet floor. It’s a basic protection almost every business needs.

Commercial Property Insurance

This covers all your business’s physical stuff – your building, computers, tools, and inventory. If a fire or theft happens, this coverage helps you repair or replace what you lost so you can get back to business.

Commercial Auto Insurance

If you use cars, vans, or trucks for work, you need this. It’s like your personal auto policy but built for business risks. It helps cover the costs of an accident when you or an employee is driving for work.

Workers’ Compensation Insurance

If you have employees, this one is essential. If an employee gets hurt or sick on the job, Workers’ Comp helps pay for their medical care and lost wages. It also protects your business from being sued over the injury. Most states we serve, like Illinois, Indiana, and Texas, require you to have it.

The mix of coverages you choose is what makes up your final cost of business insurance. A consultant might just need a couple of coverages, but a construction company will need a lot more. It’s all about matching the protection to the work you do.

Why Every Business Has a Unique Insurance Price Tag

Ever wonder why your friend with a different business pays a totally different price for their insurance? It’s because every business is looked at on its own.

An insurer’s job is to understand the risks that come with what you do. It’s not about judging your business – it’s just about figuring out the chances that you’ll need to file a claim. Your final business insurance cost is simply based on those chances.

Here are the main things that shape your insurance rate –

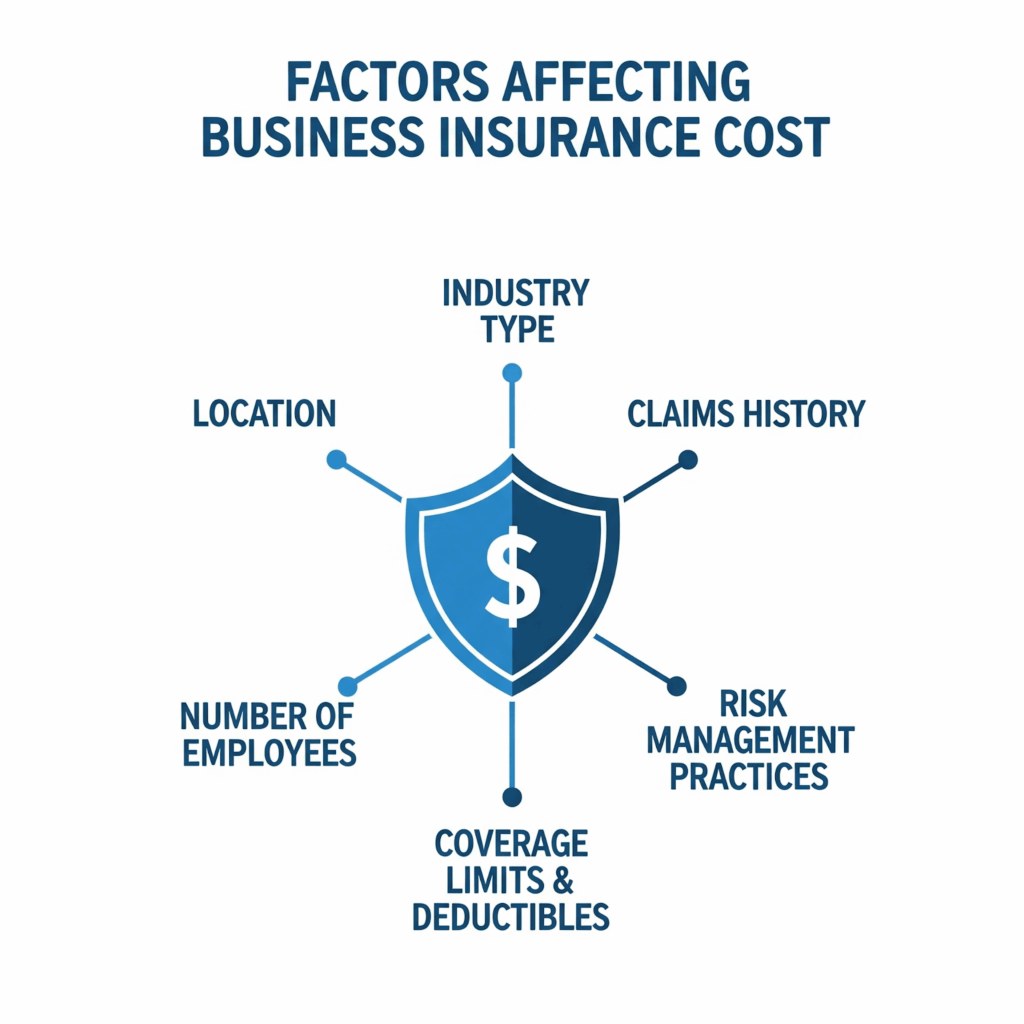

Source: AI-generated

The Type of Work You Do

What your business does is a big deal when it comes to your insurance rate. A freelance writer working from home has a pretty low risk of a customer getting hurt. But a busy restaurant or a roofing company faces a lot more risk every day.

If your work involves physical labor, big equipment, or dealing with the public, your cost of small business insurance will likely be higher. It’s because there’s simply a bigger chance of an accident.

Your Location

Your business address matters. Some places just have more risks than others. A business on the Texas coast has to think about hurricanes, while a shop in Illinois needs to be ready for winter storms.

Even the laws in your state can play a part. Some states have laws that make lawsuits more common, which can raise the small business insurance price for everyone there.

How Many People Are on Your Team

As your team gets bigger, your risk grows too. More employees mean more chances for someone to get hurt on the job. That’s why your Workers’ Compensation Insurance costs go up as you hire more people.

Adding employees can also bump you into a different price category for your other coverages. Growth is a good thing, but you’ll want to plan for the increase in your small business insurance costs that comes with it.

Here’s a quick look at how your premium might change as you add to your team –

| Employee Count | Avg Monthly Premium | Key Coverages Needed |

| 1-5 | $98 | GL, Professional |

| 6-10 | $147 | GL, Professional, WC |

| 11-25 | $203 | GL, Professional, WC, Group Health |

| 26-50 | $312 | All Above + COBRA |

| 51+ | $487 | All Above + ACA Compliance |

How Your Business Is Set Up (LLC, Corp, etc.)

The way you set up your business legally can change your insurance bill. If you have an LLC, for example, your LLC insurance cost is often lower. That’s because an LLC creates a wall between your personal stuff and your business stuff. Insurance companies like to see that. It tells them you’re planning ahead.

It can make a real difference in your overall business insurance cost.

Your Claims History

This one is pretty simple. Just like with your car insurance, having a lot of past claims can mean you’ll pay more. Insurance companies might see it as a sign that more claims are coming.

But if you have a clean record with few or no claims, you’ll likely get a better rate. It shows that you’re running a safe business.

At the end of the day, your business insurance price isn’t just a random number. It’s based on real things about your business.

Source: AI-generated

Smarter Ways to Lower Your Insurance Bill

Now for the good part: how you can actually lower your business insurance cost. You have more control over this than you might think. This isn’t about cutting corners or getting less coverage – it’s about being smart with the coverage you have.

Here are a few practical ways to manage your insurance bill –

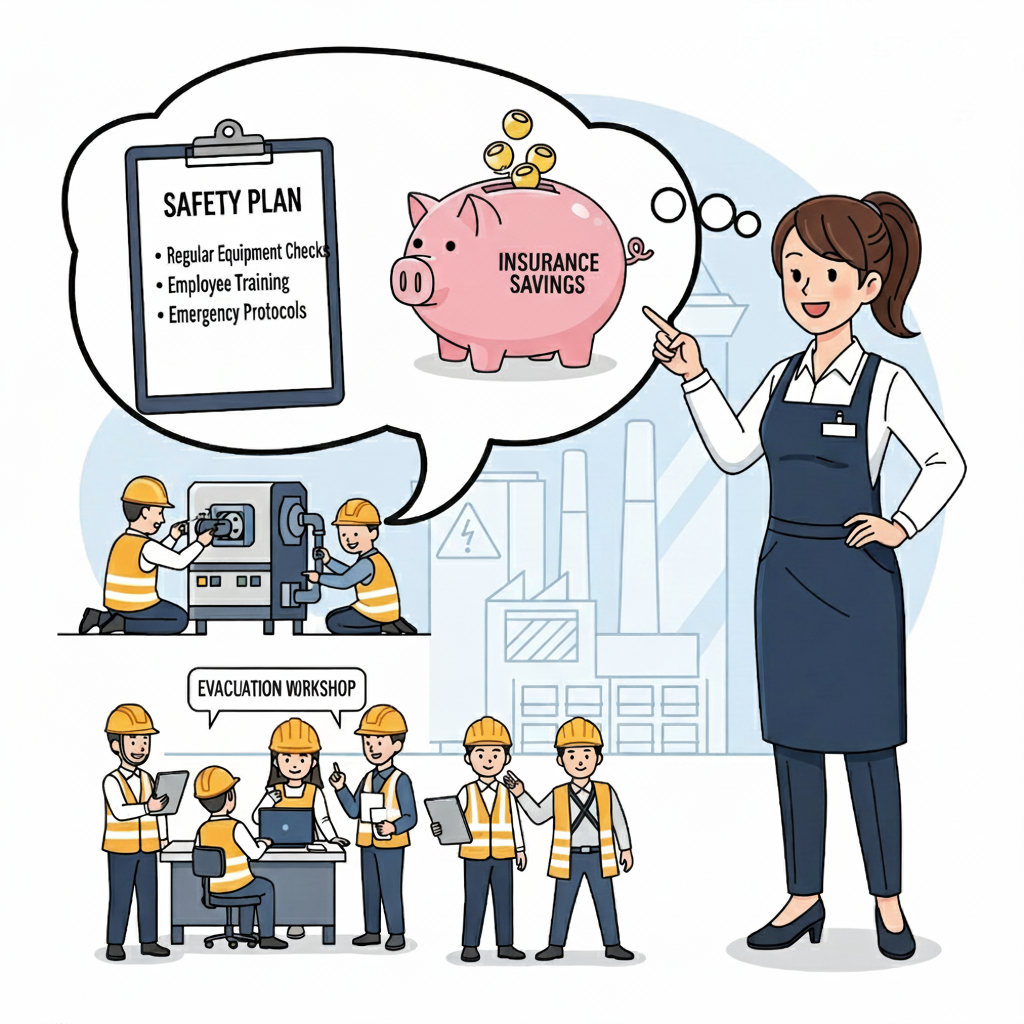

Create a Strong Safety Plan

This is a big one. Insurers like to see that you’re actively trying to prevent accidents before they happen. A simple, written safety plan can often lead to a nice discount on your premium.

Your plan doesn’t need to be fancy. It can be as simple as –

- Holding regular safety trainings for your team

- Having clear, written rules for doing tasks safely

- Keeping your workspace clean and free of trip hazards

- Doing regular maintenance on your equipment and vehicles

If your business has work vehicles, for instance, simple things like regular inspections can make a real difference in your cargo van insurance cost.

Bundle Your Policies

You know how you can often save money by bundling your home and auto insurance? The same idea works for your business. A Business Owner’s Policy (BOP) is a perfect example. It combines your general liability insurance and commercial property insurance into one simple package.

This is a great deal for two reasons – it usually costs less than buying each policy on its own, and you have less paperwork to deal with. Lowering your small business insurance prices while making your life easier is a clear win.

Check Your Coverage Yearly

Your business is always changing. Your insurance should keep up. It’s a smart move to set aside time once a year to look over your policies with your agent.

Ask yourself a few questions. Did you sell a big piece of equipment? Has your revenue gone down? Did you move to a smaller office? Any of these changes could mean you should be paying less for your insurance. A quick yearly check-in is an easy way to make sure your average cost for business insurance is right where it should be. Don’t pay for coverage you no longer need.

Choose the Right Deductible (But Be Smart About It)

Your deductible is simply the amount you agree to pay out-of-pocket on a claim before your insurance starts paying. If you choose a higher deductible, your monthly bill will usually be lower.

This can be a good way to save money if you have an emergency fund and can comfortably pay that higher amount if you need to file a claim. It’s a trade-off: a lower monthly payment for a potentially higher one-time cost. It’s all about deciding how much business insurance should cost you each month versus what you could handle if an emergency pops up.

Plan Ahead for Big Growth

It’s exciting when your business starts to take off. But those big growth spurts can sometimes bring a surprise jump in your insurance costs. We see it happen with businesses in states like Texas and Illinois.

That’s why it’s smart to give us a heads-up before you hit those big numbers – like reaching $1 million in sales or hiring your 25th employee. A little planning can save you from a big, unexpected bill. We can review your policy with you to make sure you’re ready for the change.

It’s one of the best ways to keep a handle on how much small business insurance will cost as your business gets bigger.

Answering Your Top Business Insurance Questions

We hear a lot of the same questions from business owners. Let’s get you some clear answers to the most common ones –

Do I really need Workers’ Comp insurance?

If you have employees, the answer is almost always yes. Most states require you to have Workers’ Comp insurance as soon as you hire your first person. But it’s more than just a rule you have to follow. It protects your employees if they get hurt on the job, and it protects your business from expensive lawsuits. It’s important coverage for you and your team.

What’s the difference between general liability and professional liability?

General liability vs professional liability trips up a lot of people, but it’s pretty simple when you break it down –

- General liability insurance is for physical accidents, like a customer slipping and falling in your store. Think “slip and fall”

- Professional liability insurance is for mistakes in the services you provide, like an accountant giving bad advice that costs a client money. Think “bad advice”

If you interact with the public, you need general liability. If you provide professional services or advice, you need professional liability. Many businesses need both.

How much business insurance is enough?

That’s the big question, isn’t it? The honest answer is: it’s different for everyone. The coverage a freelance writer needs is totally different from what a roofing company or a cleaning business needs. The details of janitorial insurance cost, for example, are unique to that industry.

The right answer isn’t about buying the biggest policy you can find. It’s about finding the right fit. We’ll talk with you about what you do, what your risks are, and what your budget looks like. From there, we can help you land on an amount of coverage that lets you run your business without worrying, all at a price that makes sense.

Source: Magnum Insurance

Here’s How Magnum Makes Business Insurance Simple

Getting insurance for your business can feel like a chore. It’s often confusing, it takes up time you don’t have, and you’re left wondering if you even got a good deal. We get it. And we think there’s a better way.

For over 40 years – since 1981, to be exact – we’ve been helping business owners like you. We’ve learned that people just want clear answers and a fair price. That’s our entire focus. We’re an insurance broker, which means our job is to shop around for you. Instead of you having to call a dozen different companies, you make one call to us. We do the legwork to find you the best coverage at the best price.

We also know that every dollar counts when you’re running a business. That’s why we work with you to find a payment plan that fits your budget, no matter what your credit history looks like. It’s all part of our promise – Better Price, Better Service.

Here’s a simple breakdown of the coverages we can help you with –

Your All-Around Business Insurance Plan

This is your starting point. Our business insurance plans are built around what you do every day. We’ll talk with you about your work and put together a simple plan that covers your real risks. That way, you’re not left guessing.

Commercial Auto Insurance for Your Work Vehicles

If you use a van for deliveries or a truck for hauling equipment, your personal auto policy won’t cover it. You need commercial auto insurance. It’s designed specifically for the risks of being on the road for work. If one of your vehicles is in an accident, this coverage is what helps pay for the damage and any injuries. We’ll compare the options to find you a great rate for your work vehicles.

Workers’ Comp Insurance to Protect Your Team

If you have employees, you need Workers’ Comp insurance. In most states, it’s the law. But it’s also the right thing to do. If an employee gets hurt on the job, it helps cover their medical bills and lost pay. It protects your team and your business from lawsuits that could be incredibly expensive.

General Liability Insurance for Everyday Accidents

Accidents happen. A customer could slip on a wet floor, or you could accidentally damage a client’s property. General liability insurance is what protects you from these unexpected moments. It helps pay for medical or repair bills and legal fees if you’re sued. It’s a basic protection that every business owner should have.

Commercial Property Insurance for Your Stuff

Your business runs on its physical stuff. We’re talking about your building, tools, computers, and inventory. Commercial property insurance protects them from things like fire, theft, or storm damage. If something happens, this coverage helps you repair or replace what you lost so you can get your doors back open.

A Business Owner’s Policy (BOP) to Save Money

A business owner’s policy insurance, or BOP, is a smart move for many small businesses. It bundles your general liability and commercial property insurance together. Why is that smart? You get two essential coverages in one simple policy, and it almost always costs less than buying them separately.

Professional Liability Insurance for Service Businesses

If you’re in the business of giving advice or providing a professional service, you need professional liability insurance. It’s also known as “Errors and Omissions” coverage. It protects you if a client claims you made a mistake that cost them money. If you’re an accountant, consultant, or designer, this coverage is a must-have.

Surety Bonds to Guarantee Your Work

For many contractors, getting a big job requires a surety bond. It’s basically a guarantee to your client that you’ll complete the work as promised.It shows clients you’re a pro and is often required to land those bigger jobs. We can help you get the bond you need quickly, so you can get to work.

Ready for a Quote That Makes Sense?

Getting started is easy. We’re here to help you get the right coverage without the headache –

- Give Us a Call – You can reach us at 1-888-539-2102 to talk to a real person

- Send a Message – Prefer to type? Contact us through our website

- Stop By – We have local offices. Find a location near you and come say hello

- Use Our App – You can also download our mobile app to manage your insurance on the go

We don’t just stop and protect your business! At Magnum, we can help you and your loved ones just as well! Explore our other services here

Final Thoughts

Look, your business insurance cost doesn’t have to be a complicated mystery. When you understand the moving parts, you can take control. You can make smart decisions that directly affect your bottom line.

We know that insurance can be a major source of stress for business owners – we see it all the time. Our job is to make it simple. It all comes down to knowing how to choose the right insurance for your specific needs, so you’re not paying for things you don’t need or missing coverage that you do. You’ve put in the work to build something great. Let our friendly team at Magnum make sure it’s properly covered.

Quote online or give us a call

- Choose the right insurance

- Business Insurance

- Business Owner’s Policy

- Commercial Auto

- Commercial Property

- General Liability

- Life Insurance

- MIA Dental Insurance

- MIA Vision Insurance

- Professional Liability

- Surety Bonds

- Workers Compensation

- Select state

- Arizona

- Illinois

- Indiana

- Nevada

- New Mexico

- Texas