What Goes Into Your Commercial Umbrella Insurance Cost? A Simple Guide

You’ve put everything into your business. Long days, early mornings – you’ve done it all to build something you can be proud of. You’ve probably got insurance to cover the everyday bumps and bruises, which is a smart first step.

But have you ever had that little voice in the back of your head ask, “What if something really big happens?” A major accident, a huge lawsuit – the kind of thing your standard policy might not be enough to cover. That’s a heavy thought, and it’s where something called commercial umbrella insurance comes in. It’s a topic that can feel complicated, but it doesn’t have to be. We believe that it’s important to get down to brass tacks when choosing the right business insurance for your endeavors. Let’s talk about what it is and what it means for you.

Table of Contents

- TL;DR

- What Is Commercial Umbrella Insurance, Really?

- How Is My Umbrella Insurance Price Actually Decided?

- Are There Smart Ways for a Small Business to Save Money?

- How Magnum Makes Getting Covered Easy

- Final Thoughts

TL;DR

- What It Is – An extra layer of liability protection that kicks in when your other main policies, like general liability or commercial auto, have been maxed out

- How It’s Priced – Your final price is unique to your business. The type of work you do, where you’re located, the strength of your existing policies, and your safety history all play a major part

- How to Save Money – You have more control than you think. Smart moves like planning for future growth, bundling your policies, and working with an independent agent can lead to real savings

- Why It Matters – It’s your ultimate safety net. It can protect your business from a single, catastrophic lawsuit or accident that could otherwise be financially devastating

What Is Commercial Umbrella Insurance, Really?

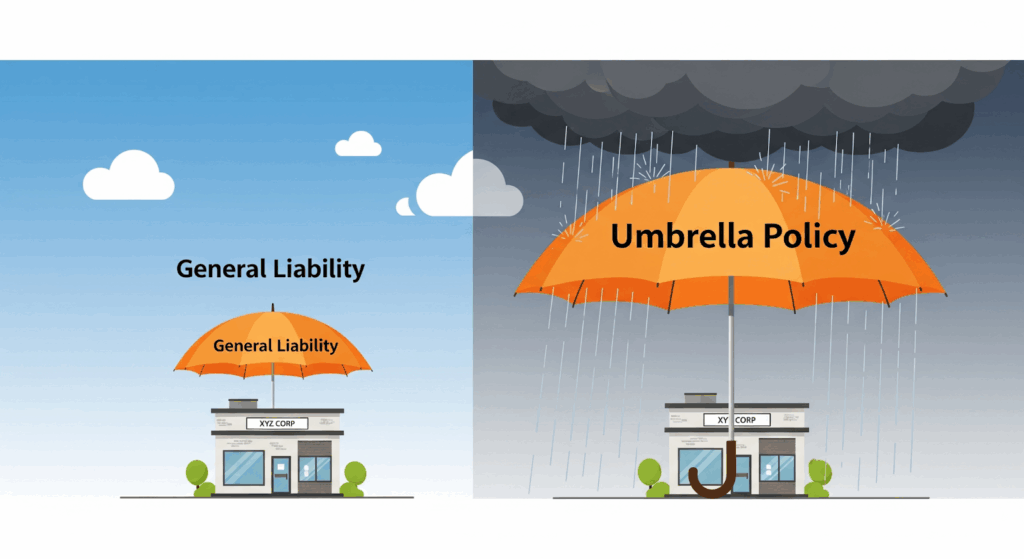

Before we get into the price, let’s talk about what commercial umbrella insurance is. Simply put, it’s an extra layer of protection for when a claim is much bigger than your main policies can handle. It’s a backup plan for major events.

It’s a Backup for Your Main Policies

Think of your main policies, like your general liability and commercial auto, as your everyday raincoat. It handles the normal showers just fine. A commercial umbrella policy is the big, heavy-duty umbrella you grab for a serious storm. It only kicks in after your main policy’s limit has been reached, giving you much higher protection for those rare but serious situations.

So, if your main policies have higher limits, you’re less likely to need your umbrella policy. Insurers see this as a lower risk and will often give you a better price for your umbrella coverage. On the other hand, if your main policies have lower limits, the risk is higher, and the umbrella policy might cost a bit more. It’s all about how the pieces work together.

A Real-World Example

Here’s how it works in the real world. Imagine one of your company vans causes a major accident. The total cost for damages and medical bills is $1.5 million. Your commercial auto insurance has a $1 million limit, so it pays that first million. But what about the other $500,000?

Without an umbrella policy, that money comes out of your business’s pocket. With an umbrella policy, it steps in to cover that remaining half-million dollars, protecting your business from a huge financial hit. It works the same way if a customer has a serious fall and the lawsuit costs more than your general liability limit.

Source: AI-generated

Is It Just for Big Companies?

This isn’t just a tool for giant companies. A small business umbrella insurance is one of the smartest, most affordable ways a growing business can protect itself. It’s a simple way to make sure one bad day doesn’t jeopardize everything you’ve worked for.

How Is My Umbrella Insurance Price Actually Decided?

Most business owners ask: how much does an umbrella policy cost? When you hear about millions of dollars in extra protection, it’s easy to assume the price will be steep. But the good news is, it’s often one of the best deals in insurance.

Your main policies are designed to handle the more common, everyday risks. An umbrella policy is only for rare events. Because the chances of it being used are much lower, the price is usually a small fraction of what you pay for your other business policies. Often, the cost for an entire year of umbrella protection is less than what you might pay for just a few months of your main coverage.

Your final commercial umbrella insurance cost isn’t a mystery. It’s based on a few common-sense factors that help an insurer get a clear picture of your business. Let’s look at the main ones.

The Kind of Work You Do

What you and your team do all day is the biggest factor in your price. It’s all about the real-world situations your business faces. A busy restaurant in Arizona with hundreds of customers coming and going every day has a very different risk of a major slip-and-fall lawsuit than a quiet bookstore. A construction company in Texas with crews working on active job sites with heavy machinery has a much different risk profile than an accounting firm where employees are at their desks.

It all comes down to the chances of a major accident happening. The more public interaction your business has, the more you work with potentially dangerous equipment, or the more your employees are out on the road, the higher the risk of a big claim. An insurer will look at what your team is really doing day-in and day-out to understand your unique situation.

Where Your Business Is Located

Where you set up shop really matters. A business located in a major city in Illinois faces different risks – like heavy traffic and more public interaction – than a business in a quiet town in Indiana. The local weather can also play a part; a business on the Texas coast has to consider the risk of major storms, which can lead to complex and expensive claims.

But it’s not just about weather. Every state, and even different counties, can have its own unique legal environment. Some areas are known for having more lawsuits, and the average cost of a settlement in those places can be much higher. That’s why commercial auto insurance in Arizona, Indiana, and Nevada may differ because each state has its own insurance laws and risk factors. This is where having a local agent makes a huge difference. We understand the local trends and know what’s happening in your specific community. Whether you need business insurance in Illinois, Arizona, or Nevada, we’ve got you covered because we’re right here with you.

The Strength of Your Current Policies

Your umbrella policy works with your other insurance, so the strength of those main policies matters a lot. Think of it like this – your main policies are your first line of defense. If they’re strong, with good coverage limits, your umbrella is less likely to be needed.

Insurers see this as a lower risk, which often means a lower price for you. Getting the right mix of general liability vs professional liability is a key part of building that strong base.

Your Safety and Claims History

This one is simple: a safe business pays less. Your claims history tells an insurer how responsible you are. If you have a clean record with few or no claims over the years, it’s clear that you take safety seriously. Insurers almost always reward that with a better price. It’s a direct payoff for running a safe, tight ship.

What Should You Expect to Pay?

So, let’s talk about the price in a simple way. How much does commercial umbrella insurance cost? While every business’s price is unique, a common surprise for many owners is how affordable this extra protection can be. For most, the average umbrella insurance cost is a small fraction of what they pay for their other main policies. It’s not unusual for a full year of umbrella coverage to cost less than just a few months of your primary business insurance.

The price often comes down to your industry. A retail shop has very different risks than a construction company, and their prices will reflect that. A good rule of thumb is to think about it as a small percentage of your annual sales. If your umbrella liability insurance for business costs seems high compared to your revenue, it’s a good sign you should ask more questions – and we’re here to help with that.

Are There Smart Ways for a Small Business to Save Money?

Yes, absolutely. You have more control over your insurance costs than you might think. There are several simple, smart choices you can make that can directly lower your average umbrella insurance cost.

Clearly, this isn’t about cutting corners or getting less protection. It’s about being proactive and showing insurers that you’re a responsible business owner who takes safety seriously. When you can do that, you often get rewarded with a better price. It really is that simple.

Here are a few tips to get you started –

Think a Few Years Ahead

This might be one of the most valuable tips we can offer a growing business. It’s easy to buy an insurance policy that perfectly fits your business right now. But if you have plans to expand, it’s always cheaper to buy coverage for the business you plan to be in the next three to five years.

Think of it like buying a winter coat. You wouldn’t buy one that’s skin-tight, with no room to wear a sweater underneath. You buy one with a little room to grow and layer. It’s the same idea with your umbrella insurance for small businesses.

Let’s say you run a small contracting business with two trucks, but you have a solid plan to expand to five trucks in the next three years. Getting a policy that accounts for that planned growth from the start is more affordable than asking for a big increase two years down the road. Why? Because insurers like a predictable plan. A sudden, reactive request for more coverage can look risky, and the price will often reflect that. A little foresight goes a long way.

A Quick Checklist for Your Future Plans

- Where do you see your sales going in the next 3-5 years?

- Are you planning on buying any major new equipment or property?

- Do your biggest clients require you to have a certain amount of insurance?

- Are there any new or growing risks in your specific industry?

- Are you thinking about expanding to a new city or state?

- How many new people do you plan to hire in the next few years?

Source: AI-generated

Bundle Your Main Policies to Save

Here’s a smart way to save some money. A Business Owner’s Policy, or BOP, is a great choice for many small businesses. It bundles your main coverages, like general liability and commercial property insurance, into one simple package.

It’s a good deal for two reasons. First, it usually costs less than buying those policies one by one. Second, it makes your life easier. You get one policy, one bill, and one number to call.

Having a strong, bundled policy like a BOP is a great foundation. It can also help lower your overall umbrella liability insurance cost when you’re ready for that extra layer of protection.

Work with an Agent Who Shops for You

This might be the most important tip we can give you. You could spend days calling different insurance companies, trying to make sense of confusing quotes. Or, you could make one phone call to us.

That’s the benefit of working with an independent agent. It’s important to know the difference between captive agents and independent agents. A captive agent works for one company and can only offer their products. An independent agent works for you.

At Magnum, we’re independent insurance agents for-the-win. Our job is simple: we take what your business needs and shop it around to find you the best coverage at the best price. We explain your options in plain English and handle all the legwork. You get a great deal and can stay focused on running your business.

Look into Group Programs

Many industry and trade associations offer group insurance plans for their members. It’s a great way to use the power of numbers to your advantage. Because the association is buying insurance for a large group of similar businesses, they can often get a much better rate than a single small business could on its own.

It’s always worth checking if a trade group you belong to offers a program like this. It could lead to real savings.

Have a Simple Plan for When Things Go Wrong

It’s not just about if you have claims; it’s also about how you handle them. Having a clear and simple process for dealing with incidents can make a huge difference. A quick and organized response shows you’re on top of things and can help resolve claims faster.

This doesn’t need to be a complicated, formal process. It can be as simple as a one-page checklist that your managers have on hand. The list could include –

- First Steps – Make sure everyone is safe

- Who to Call – Your main contact person at your business and your Magnum agent

- What to Write Down – The date, time, location, and a simple description of what happened

- Photos – If it’s safe, take a few pictures of the scene

Why a Simple Plan Helps Lower Your Costs

Having a plan in place before you need it is just a smart move. It shows an insurer that you’re a responsible, well-managed business. It proves that even when something unexpected happens, you have a simple way to handle it calmly.

Over time, this can lead to a stronger safety record and a cleaner claims history. A business that can show it’s organized and serious about safety is seen as a lower risk. That is a key part of keeping your umbrella insurance cost down in the long run.

How Magnum Makes Getting Covered Easy

We get it – you’re busy running your business. You don’t have the time to become an insurance expert, and you shouldn’t have to. That’s where we come in.

One Call Covers It All

Think of us as your one-stop shop for business insurance. Since 1981, we’ve been helping business owners protect what they’ve worked so hard to build. As independent agents, we don’t work for just one insurance company; we work for you. Our job is to do the shopping for you, comparing options from many different providers to find the right fit for your needs and budget.

We understand the local rules and what it takes to get covered in your state, whether you need a New Mexico Surety bond or want to understand the ins and outs of workers comp in Arizona and Illinois. Our team handles the details so you can stay focused on your business.

The Protection You Need, All in One Place

Here’s a look at the different ways we can help you stay protected –

- Commercial Umbrella Insurance – This gives you an extra layer of protection for major claims that max out your other policies

- Business Insurance – This is your main coverage, built around the work you do every day

- Commercial Auto Insurance – If you use vehicles for work, we find you affordable coverage. We know that for many businesses, the details of box truck insurance cost or cargo van insurance cost are a top priority

- Workers’ Comp Insurance – This protects your team if they get hurt on the job. If you’re wondering, ‘Do I really need workers comp insurance?’, we can walk you through your state’s requirements

- General Liability – This covers you if a customer gets hurt at your business or if you accidentally damage someone’s property. For some businesses, like cleaning companies, janitorial insurance is a must

- Commercial Property Insurance – This protects your business’s stuff – your building, tools, computers, and inventory

- Business Owners Policy (BOP) – A smart package that bundles your property and liability coverage to save you money

- Professional Liability Insurance – This protects you from claims that you made a mistake or had an error in your professional services

- Surety Bonds – We can help you get the bond you need to guarantee your work, whether it’s an Arizona Surety bond or an Indiana Surety bond

Ready for a Clear Quote?

Getting a quote shouldn’t be complicated. We stand by our promise of Better Price, Better Service, and that starts with giving you clear answers and a quote that’s easy to understand.

- Give Us a Call – 1-888-539-2102

- Contact us online

- Find a location near you

- Download our mobile app

Source: Mangum Insurance

Final Thoughts

Let’s keep it simple. An umbrella policy is about being ready for a major event so you can keep your business running. Your commercial umbrella insurance cost doesn’t have to be a huge expense. It’s a smart, manageable part of protecting your business.The main takeaway is this – you don’t have to figure this out on your own. Umbrella liability insurance for business can feel complicated, but we’re here to make it simple. It all works together with your other policies, like your workers’ compensation insurance. At Magnum, we’re here to help you put the right pieces in place to protect the business you’ve worked so hard to build.

Quote online or give us a call

- Choose the right insurance

- Business Insurance

- Business Owner’s Policy

- Commercial Auto

- Commercial Property

- General Liability

- Life Insurance

- MIA Dental Insurance

- MIA Vision Insurance

- Professional Liability

- Surety Bonds

- Workers Compensation

- Select state

- Arizona

- Illinois

- Indiana

- Nevada

- New Mexico

- Texas